Hong Kong (AFP) – The dollar rose Tuesday and Asia equities were mixed as investors weighed the possibility of another Donald Trump presidency after last week’s poor debate performance by incumbent Joe Biden.

Speculation about a second term for the Republican rose on the Supreme Court’s ruling that all former leaders had “absolute immunity” from criminal prosecution for “official acts” taken while in office but could still face criminal penalties for “unofficial acts”.

The decision comes as Trump faces criminal charges over his attempts to overturn his 2020 election loss to Biden, but that trial had been put on hold while judges considered his immunity claims.

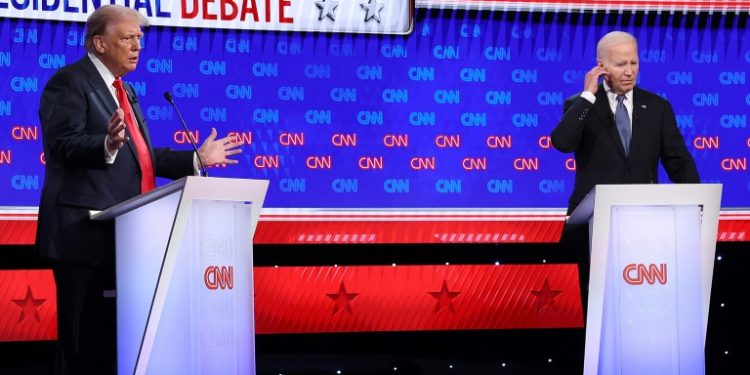

Bets on a second term for the controversial tycoon rose after Thursday’s debate, in which he was widely considered to have come out on top after Biden struggled through answers and stumbled over his lines.

That led to calls for him to step down due to worries over his mental state, but Democrats have pushed back and are reportedly seeking a vote next month that would formally make him the party candidate for November’s poll.

“Those two headlines, and given the reaction to President Biden’s first debate, continue to suggest a Trump presidency is looking more likely at this stage,” Tapas Strickland at National Australia Bank said in a commentary.

Observers said the prospect of another Trump presidency fuelled talk of tax cuts and a fresh spike in inflation, pushing up yields and denting hopes for interest rate cuts.

That, in turn, boosted the dollar against its main peers, pushing back to 38-year highs against the yen, putting Japanese authorities on alert after they previously warned they were ready to intervene in forex markets to support the unit.

The euro was also a little softer, though it managed to hold most of the gains made Monday in a relief rally that came after the far-right National Rally (NR) looked unlikely to win an absolute majority in French legislative elections as had been feared.

President Emmanuel Macron and his allies are now involved in intense campaigning and horse-trading ahead of the second round of polls Sunday as they look to deny NR an absolute majority and control of government.

However, Luca Santos at ACY Securities said: “Based on current results, the two most probable outcomes are a hung parliament without an absolute majority or an RN cohabitation government.

“The high number of constituencies won by the RN, coupled with tight races between left and centre candidates, complicates strategic withdrawals and heightens the risk of an RN cohabitation government, which would be less favourable for the euro.

“Consequently, the euro’s current relief rally is unlikely to persist ahead of the second election round.”

Asian stock markets were mixed, with Hong Kong enjoying a rare surge after a recent run of losses, while Tokyo piled on more than one percent to end above 40,000 points for the first time since April.

Shanghai, Singapore, Mumbai and Jakarta also rose.

However, Sydney, Seoul, Wellington, Bangkok, Taipei and Manila fell along with London, Paris and Frankfurt.

– Key figures around 0810 GMT –

Tokyo – Nikkei 225: UP 1.1 percent at 40,074.69 (close)

Hong Kong – Hang Seng Index: UP 0.3 percent at 17,769.14 (close)

Shanghai – Composite: UP 0.2 percent at 2,997.01 (close)

London – FTSE 100: DOWN 0.6 percent at 8,119.33

Euro/dollar: DOWN at $1.0717 from $1.0743 on Monday

Dollar/yen: UP at 161.65 yen from 161.46 yen

Pound/dollar: DOWN at $1.2624 from $1.2648

Euro/pound: DOWN at 84.89 pence from 84.92 pence

West Texas Intermediate: UP 0.1 percent at $83.43 per barrel

Brent North Sea Crude: UP 0.1 percent at $86.67 per barrel

New York – Dow: UP 0.1 percent at 39,169.52 (close)

© 2024 AFP