Frankfurt (Germany) (AFP) – European Central Bank policymakers look increasingly likely to cut interest rates again on Thursday, with US President Donald Trump’s stop-start tariff announcements sowing concern in the eurozone. The uncertainty around Trump’s next move, and the negative impact it could have on growth within the single currency bloc, has intensified calls for the ECB to ease borrowing costs further. Worries over rising prices have faded into the background, as once sky-high inflation rates have drifted back down towards the ECB’s two-percent target. The central bank has made six quarter-point cuts since June last year as inflation has fallen, bringing its benchmark deposit rate down to 2.5 percent from four percent.

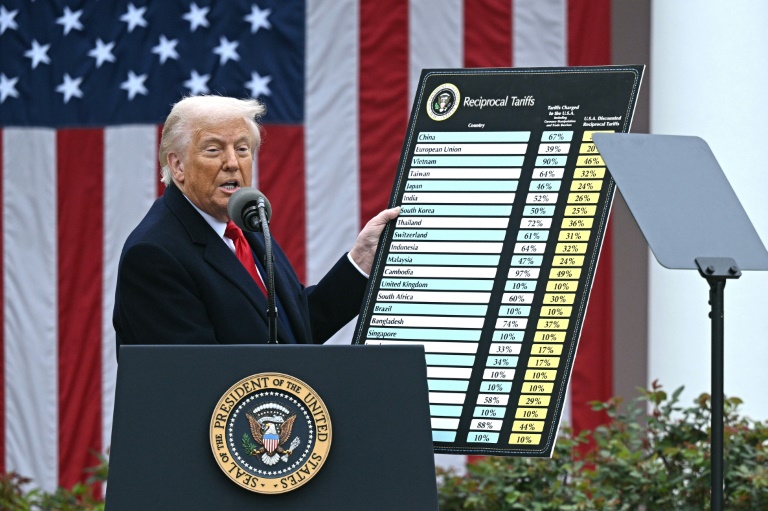

After such a long cutting streak, the central bank “seemed set for a pause” after its last meeting in March, ING bank analyst Carsten Brzeski said. But the picture has changed significantly since Trump’s announcement of a new round of swingeing tariffs, which he referred to as “Liberation Day”. Trump imposed 10 percent tariffs on all imports into the United States. His decision to suspend even higher tariffs for most countries for 90 days and invitation to key trading partners to cut a deal have done little to quell concerns. “US tariffs on the EU and many other countries have brought back growth concerns for the eurozone, at least in the nearer term,” Brzeski said. For the members of the ECB’s governing council meeting in Frankfurt, a pause in rate cutting was “no longer an option,” he said.

– ‘Trade uncertainty’ –

Going into the meeting, eurozone policymakers could not be sure what tariff rates would eventually apply to transatlantic trade. For now, Trump has rowed back on his initial decision to hit all European Union imports with a basic 20 percent tariff, which could rekindle inflation. But the White House has also imposed 25 percent levies on the automotive, steel, and aluminium sectors, and opened probes into semiconductors and pharmaceuticals that could lead to more industry-specific tariffs. “Heightened trade uncertainty and tighter financial conditions” caused by Trump’s announcements have increased the “downside” risk for the eurozone, according to analysts at Italian lender UniCredit. In that context, another cut to relieve stress on households and businesses and support the economy seemed “straightforward,” the analysts said.

The ramifications of higher US tariffs would “outweigh the positive impulse” given by massive planned spending in the eurozone’s biggest member, Germany, they said. The incoming government in Berlin led by Friedrich Merz has lined up hundreds of billions of euros in extra cash for defence and infrastructure, providing a boost that could be felt across Europe.

– ‘Always ready’ –

But Germany’s stimulus measures would only “kick in” in 2026, while the impact of Trump’s shake-up of the global trading system would be felt almost immediately, the UniCredit analysts warned. As for the prices of goods and services, US tariffs made a “further decline in inflation in the eurozone even more likely,” said Robert Greil, a strategist at private bank Merck Finck. Inflation among the 20 members of the eurozone has come down significantly from the double-digit highs seen in late 2022 and sat at 2.2 percent in March. The single currency has gained in strength relative to the dollar, which should make imports cheaper going forward, while hefty US tariffs on China could see cheap goods diverted to Europe, Greil said.

Observers will listen carefully to ECB president Christine Lagarde’s remarks after the rates announcement for a hint of how the ECB may respond going forward. Lagarde last week signalled policymakers’ willingness to support the eurozone in a more critical scenario, where Trump’s tariff blitz caused a threat to financial stability. The ECB “is always ready to use the instruments that it has available,” Lagarde said in Warsaw.

© 2024 AFP