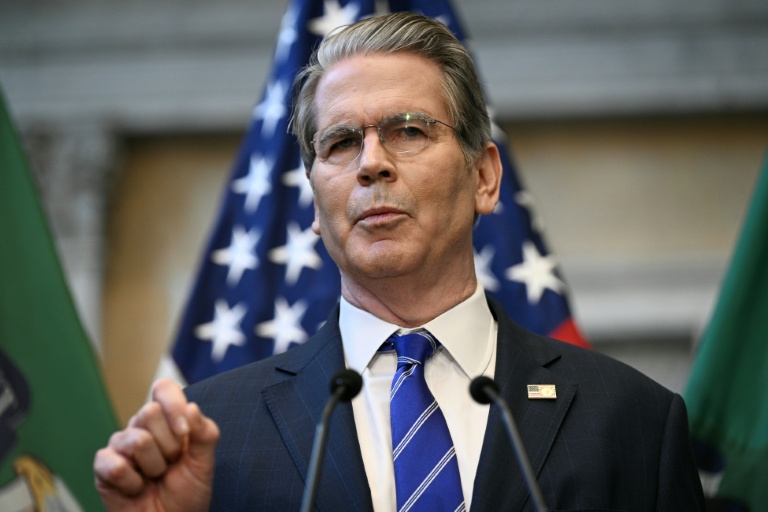

Washington (AFP) – The EU will urge G7 partners to consider tapping immobilized Russian assets in aiding Ukraine, the bloc’s economy commissioner told AFP on Wednesday, as finance ministers of the group convene in Washington. Also on the Group of Seven ministers’ agenda are discussions on China’s recently announced curbs on rare earths, commissioner Valdis Dombrovskis told AFP in an interview.

European allies have been working on a plan to provide loans to Ukraine without an outright seizure of Russian assets that have been immobilized after Moscow’s invasion of Ukraine in 2022. “UK and Canada have already indicated willingness to work alongside with the EU’s reparation loan model,” Dombrovskis said. “So, we’re also awaiting more concrete responses from (the) US and Japan,” he added on the sidelines of the International Monetary Fund and World Bank’s fall meetings in Washington this week. He stressed that G7 leaders earlier agreed at the finance ministers level to “work in a coordinated way.”

Dombrovskis said he intends to outline the EU’s plans when G7 finance leaders gather, while encouraging partners to see what they can do with frozen assets in their territories. The leaders will also discuss work on further sanctions. Under the European Union’s plan, the EU would borrow funds from international deposit organization Euroclear in Belgium that have matured into cash, and the money would in turn be loaned to Ukraine. The understanding is that any funds Russia pays towards post-war reparations would be used to reimburse the Europeans. The Kremlin has said the EU plan amounts to “theft” and has threatened to retaliate. Meanwhile, Belgium is seeking guarantees that the bloc would share risks on the plan.

– ‘We are ready’ – G7 leaders are also expected to discuss potential responses to China, after Beijing recently announced fresh export curbs involving the rare earth industry, triggering a fiery response from Washington. Early Wednesday, US Trade Representative Jamieson Greer slammed China’s move as a “global supply chain power grab,” saying that the United States and its allies would not go along with such a system of controls by Beijing. Dombrovskis told AFP that although no concrete decisions have been made at the EU level, “we are ready to engage and to coordinate those approaches, including at the G7 level.”

“We are willing to discuss what is the best way to approach it, both in the short-term, but also in the longer term. It’s obvious that we need to work on the diversification of our supply chains,” he said. EU trade commissioner Maros Sefcovic said Tuesday that the EU is coordinating with G7 partners on a response to China’s rare earths export controls, while engaging with China to find solutions.

Asked about further progress to seek a reduction in US tariffs targeting EU goods, Dombrovskis noted Wednesday that “there’s a lot at stake economically.” He said he foresees further discussions on sector-specific tariffs, after Brussels managed to negotiate lower duties on auto exports to the United States.

– ‘Sizable’ hit – Separately, Dombrovskis noted that a suspension of France’s pension reform would have significant implications, stressing the need for the eurozone’s second-largest economy to ensure it meets its budget commitments. On Tuesday, France’s Prime Minister Sebastien Lecornu backed the suspension of the unpopular 2023 reform — a key move to bolster his cabinet’s survival and draw his country out of political crisis. “There are quite sizable fiscal implications,” Dombrovskis said. “So, it’s important that indeed there are measures taken to ensure that France still meets its commitments in line with its medium-term fiscal structural plan,” he added.

Freezing the pension reform would cost around 400 million euros ($463 million) in 2026 and 1.8 billion euros the following year, Lecornu previously said. He added that the shortfall should be covered by savings. France’s debt-to-GDP ratio is the EU’s third-highest after Greece and Italy, and is close to twice the 60-percent limit fixed by EU rules.

© 2024 AFP