London (AFP) – European stock markets dropped Tuesday after Seoul rebounded as traders focused on political upheaval in France and South Korea in addition to China’s latest stimulus plans. Commodity markets were steadier after oil and gold won strong support Monday owing to an uncertain future for Syria and the wider crude-rich Middle East.

The Paris stock market retreated and the euro fell versus the dollar, as French party leaders were set to gather at President Emmanuel Macron’s Elysee Palace office to chart a route towards a new government. Wall Street on Monday pulled back from all-time highs as investors awaited key US inflation data this week. Stock markets struggled “amid concerns that China’s economic stimulus measures might not have a long-lasting effect,” noted Dan Coatsworth, investment analyst at AJ Bell.

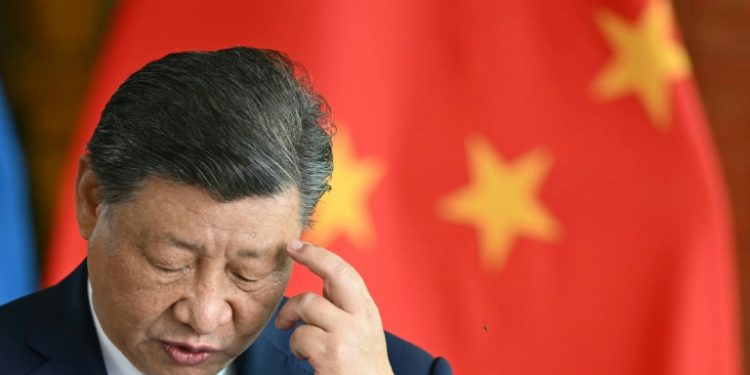

Official data Tuesday showed Chinese exports rose in November at a slower rate than expected while imports shrunk further, reinforcing the need for more support a day after top officials pledged to bolster the stuttering growth. Following the data’s release, Chinese President Xi Jinping said: “China has full confidence to achieve this year’s economic growth target and will continue to play its role as the biggest engine of world economic growth.” The growth plan comes as Beijing contemplates Donald Trump’s second term in the White House. The US president-elect has indicated he will reignite his hardball trade policies, fuelling fears of another standoff between the superpowers.

Leaders have battled for almost two years to kickstart China’s economy, which has been battered by weak domestic consumption and a debilitating property sector crisis. “Beijing kept its stimulus measures very modest in 2024, because the goal was to stabilise the economy and rehabilitate confidence,” said Shehzad Qazi, managing director at consultants China Beige Book. “Now, Beijing is almost singularly focused on protecting China from the onslaught of forthcoming Trump tariffs.”

The Shanghai stock market ended higher and Hong Kong fell. Seoul’s Kospi index rallied more than two percent after tumbling since President Yoon Suk Yeol declared short-lived martial law on December 3. The South Korean won currency steadied against the dollar Tuesday, though it remains stuck near two-year lows as uncertainty keeps investors on edge.

On the corporate front, shares in Stellantis rose slightly on the Paris index after the car giant and Chinese manufacturer CATL announced plans for a $4.3-billion factory making electric-vehicle batteries in Spain. Shares in Ashtead slumped 12 percent in London after the industrial-equipment hire group warned over profits and said it plans to switch its main stock listing to the key market in the United States.

– Key figures around 1100 GMT –

Paris – CAC 40: DOWN 0.6 percent at 7,432.92 points

Frankfurt – DAX: DOWN 0.1 percent at 20,335.96

London – FTSE 100: DOWN 0.6 percent at 8,302.48

Hong Kong – Hang Seng Index: DOWN 0.5 percent at 20,311.28 (close)

Shanghai – Composite: UP 0.6 percent at 3,422.66 (close)

Tokyo – Nikkei 225: UP 0.5 percent at 39,367.58 (close)

Seoul – Kospi: UP 2.4 percent at 2,417.84 (close)

New York – Dow: DOWN 0.5 percent at 44,401.93 (close)

Euro/dollar: DOWN at $1.0526 from $1.0555 on Monday

Pound/dollar: UP at $1.2756 from $1.2746

Dollar/yen: UP at 151.63 yen from 151.21 yen

Euro/pound: DOWN at 82.54 from 82.78 pence

West Texas Intermediate: DOWN 0.9 percent at $67.79 per barrel

Brent North Sea Crude: DOWN 0.8 percent at $71.59 per barrel

© 2024 AFP