London (AFP) – Global stock markets lost ground along with the euro Tuesday on concerns about the potential economic fallout should the far right win power in France in weekend elections.

London was also lower and the pound traded mixed heading into a UK general election Thursday which the opposition Labour Party is expected to win.

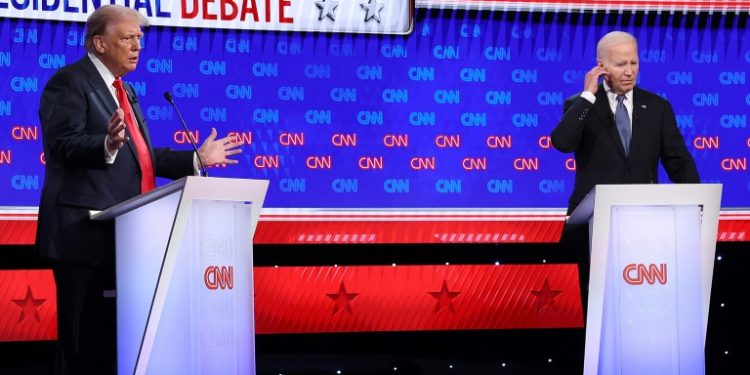

The dollar firmed as investors weighed the possibility of another Donald Trump presidency after last week’s poor debate performance by incumbent Joe Biden.

Wall Street stocks struggled to find direction with the Dow flat although the tech heavy Nasdaq continued its upward momentum by rising 0.3 percent two hours into the session.

Markets are waiting on employment data, with analysts pointing to caution while Federal Reserve Chair Jerome Powell participates in a panel discussion with other central bankers.

“Political concerns continue to weigh on European stocks,” noted Joshua Mahony, chief market analyst at Scope Markets.

“Given the political shockwaves being felt around Europe, the prospect of a stable political environment could yet help place the UK economy as a haven for years to come,” he added, striking a note of contrast between the UK and French elections.

Fawad Razaqzada, market analyst at StoneX, noted that “the potential for (Marine) Le Pen’s National Rally party to govern France is a key risk one cannot ignore.” Candidates in France on Tuesday faced a deadline to register for the run-off round of a high-stakes parliamentary election, as President Emmanuel Macron’s centrist camp and a left-wing alliance scrambled to prevent the far-right from taking power.

On Sunday, French voters go to polls for the decisive final round of the snap election Macron called after his camp received a drubbing in European elections last month.

His gamble appears to have backfired, with the far-right National Rally (RN) of Marine Le Pen scoring a victory in the first round of voting last Sunday.

Ahead of the vote, official data Tuesday showed eurozone inflation cooled in June — but experts said it would be insufficient to convince the European Central Bank, or ECB, to accelerate its rate-cutting cycle despite sluggish economic growth.

Consumer prices have remained stubbornly above the ECB’s two-percent target, although the return to easing inflation will no doubt be welcomed by officials.

Consumer price inflation in the single currency area came in at 2.5 percent in June, down from a 2.6-percent rate in May, the EU’s statistics agency said. In Britain, the main opposition Labour party is this week on course to end 14 years of power by the Conservatives and the premiership of Rishi Sunak.

Elsewhere Tuesday, Asia’s main stock markets closed higher, with Hong Kong enjoying a rare surge after a recent run of losses.

Tokyo piled on more than one percent to end above 40,000 points for the first time since April.

– Key figures around 1645 GMT –

New York – Dow: DOWN 0.1 percent at 39,114.25 points

Paris – CAC 40: DOWN 0.3 percent at 7,538.29 (close)

Frankfurt – DAX: DOWN 0.7 percent at 18,164.06 (close)

EURO STOXX 50: DOWN 0.5 percent at 4,903.48

London – FTSE 100: DOWN 0.6 percent at 8,121.20 (close)

Tokyo – Nikkei 225: UP 1.1 percent at 40,074.69 (close)

Hong Kong – Hang Seng Index: UP 0.3 percent at 17,769.14 (close)

Shanghai – Composite: UP 0.2 percent at 2,997.01 (close)

Euro/dollar: DOWN at $1.0736 from $1.0743 on Monday

Euro/pound: DOWN at 84.69 pence from 84.92 pence

Pound/dollar: UP at $1.2676 from $1.2648

Dollar/yen: UP at 161.52 yen from 161.46 yen

Brent North Sea Crude: UP 0.4 percent at $86.94 per barrel

West Texas Intermediate: UP 0.2 percent at $83.54 per barrel

burs-bcp/rfj/cw/ach

© 2024 AFP