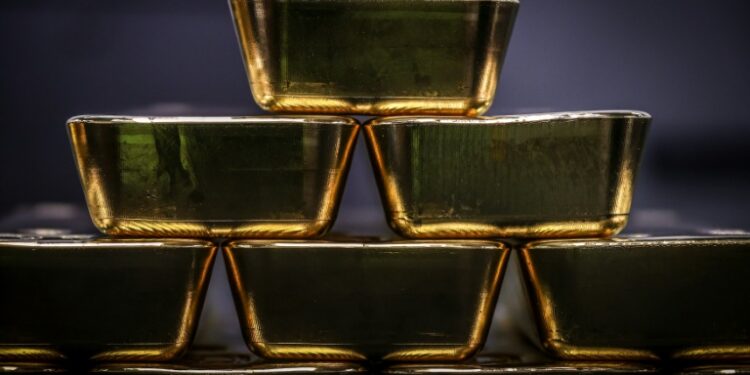

London (AFP) – Investors nervous about geopolitics, tariff threats, and domestic US budgetary issues flocked to buy gold Monday, pushing the safe-haven precious metal well into record territory. The dollar sank, meanwhile, amid speculation of US-Japanese central bank coordination to support the yen.

Gold climbed above $5,100 an ounce, having cracked $5,000 on Sunday, amid rising global uncertainty and turmoil set off by US President Donald Trump’s policies. “It vaulted over the psychologically important 5,000 mark on a glittering streak, heading sharply higher as trade tensions emanating from the US unnerved investors,” said Susannah Streeter, chief investment strategist at Wealth Club. By comparison, gold could be had for just over $2,000 an ounce only two years ago. Silver prices have also spiked to record territory. “The relentless quest for hard assets continued amid yet more talk of tariffs and US government shutdowns,” said Neil Wilson, a strategist at Saxo UK.

Several US senators have said they would vote against coming government spending bills after federal agents killed a second American citizen in Minneapolis, significantly increasing the chances of a government shutdown next week. The dollar was weighed down by a surge in the yen on speculation that authorities may intervene to prop up the Japanese currency, but also by limited visibility on the US economy and inflation fears. “The FX (foreign exchange) market is front and centre at the start of this week and the focus is on the huge move higher in the yen,” said Kathleen Brooks, research director at XTB trading group. “Reports suggest that Japanese officials were joined by the Federal Reserve Bank of New York who bought yen to support the beleaguered currency,” she added.

The yen had slid amid worries about Japan’s fiscal position, the central bank’s decision to hold off on interest rate hikes, and expectations that the US Federal Reserve will stay put on the rates front this week. The stronger yen weighed on Tokyo’s stock market because of its negative impact on exporters. The US Fed is expected to hold interest rates steady this week despite Trump’s pressure to slash them, which is seen as a threat to its independence, traditionally one of the pillars of US assets’ solidity.

US stocks came off to a firmer start, helping European equity markets reverse their earlier weaker trend.

– Key figures at around 1440 GMT –

Gold – UP 1.8 percent at $5,069 per ounce

Silver – UP 8.2 percent at 109.61 per ounce

New York – Dow: UP 0.3 percent at 49,285.93 points

New York – S&P 500: UP 0.2 percent at 6,932.76

New York – NASDAQ: UP 0.1 percent 23,516.57

London – FTSE 100: UP 0.2 percent at 10,165.03

Paris – CAC 40: UP 0.1 percent at 8,150.56

Frankfurt – DAX: UP 0.1 percent at 24,936.81

Tokyo – Nikkei 225: DOWN 1.8 percent at 52,885.25 (close)

Hong Kong – Hang Seng Index: UP 0.1 percent at 26,765.52 (close)

Shanghai – Composite: DOWN 0.1 percent at 4,132.61 (close)

Dollar/yen: DOWN at 153.91 yen from 157.00 yen on Friday

Euro/dollar: UP at $1.1868 from $1.1823

Pound/dollar: UP at $1.3676 from $1.3636

Euro/pound: UP at 86.79 from 86.70 pence

Brent North Sea Crude: DOWN 0.3 percent at $64.91 per barrel

West Texas Intermediate: DOWN 0.3 percent at $60.90 per barrel

burs/jh/js

© 2024 AFP