Washington (AFP) – Two senior Federal Reserve officials praised the US central bank’s independence on Thursday, amid concerns that President-elect Donald Trump may seek to influence Fed policy. The defense was led by Fed Chair Jerome Powell, who told a conference in Dallas, Texas, that rate decisions “cannot be reversed by any other part of the government, except, of course, Congress.” Congress created the Federal Reserve System more than a century ago and later gave it a dual mandate to tackle inflation and unemployment free from political interference — primarily by raising and lowering interest rates.

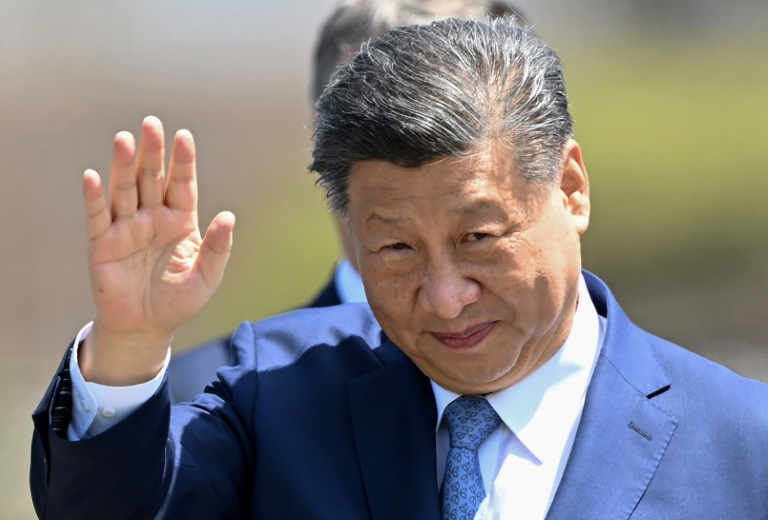

Powell’s praise echoed that of his colleague, Governor Adriana Kugler, who earlier told an event in the Uruguayan capital Montevideo that “central bank independence is fundamental to achieving good policy and good economic outcomes.” Analysts have raised concerns that the Fed’s independence could come under strain in the next Trump administration, given the views expressed by the president-elect. Trump is a fierce critic of Powell — whom he first nominated to run the US central bank — accusing him without evidence of supporting the Democrats, and once even wondering if he was a bigger enemy than Chinese President Xi Jinping. Trump has also said he has “better instincts” on the economy than many Fed governors and argued that the US president should have “at least” a say in setting interest rates. Trump’s comments suggest he may wish to influence interest rate decisions — something he cannot currently do without a change to the law.

“Congress created the Federal Reserve by statute and can do what it wishes to do by statute,” Powell said Thursday. “But our decisions are not reviewable by any other agency.” Powell declined to confirm if he would continue to serve as a Fed governor once his term as Fed chair expires in May 2026. “I’ll certainly serve to the end of my chair term,” he said. “And that’s really all I’ve decided.”

During his remarks, Powell also addressed the health of the US largest economy, praising its recent performance as “the best of any major economy in the world.” The US central bank recently started cutting back its key lending rates from a two-decade high, turning attention from tackling inflation to supporting the labor market as the rate of price increases has moderated. There has been widespread anger about the cumulative impact of years of inflation, which has pushed up consumer prices by more than 20 percent since the onset of the Covid-19 pandemic.

But the economic facts today are clear, Powell said during an event in Dallas, Texas, noting that inflation was falling toward the Fed’s long-term two percent target, the labor market was “solid,” and economic growth remained resilient. Powell noted that inflation, as measured by the Fed’s favored inflation gauge, was “running much closer” to the bank’s target, but had not reached it just yet. “We are moving policy over time to a more neutral setting,” he said, referring to the level of interest rates over the long run that keep both inflation and unemployment in check. “But the path for getting there is not preset,” he continued, adding that the Fed was in no hurry to cut rates. Futures traders currently place a probability of close to 60 percent that the Fed will cut interest rates by a quarter of a percentage point, according to data from CME Group, down sharply from a day earlier.

© 2024 AFP