New York (AFP) – Global stock markets diverged Friday in an end to a week’s trading dominated by earnings updates and angst over rising bond yields amid US election uncertainty. Wall Street stocks finished the day mixed, with the Nasdaq pressing higher and the Dow pulling back. Besides the neck-and-neck US election, investors are looking ahead to major economic data next week and earnings from tech giants.

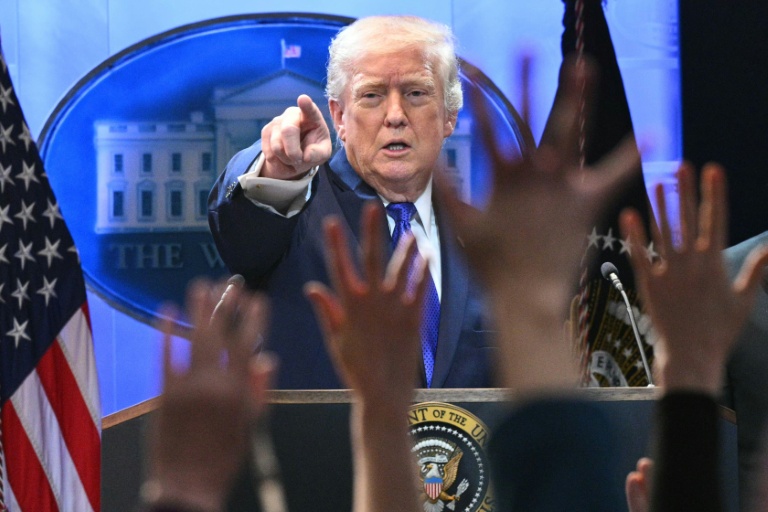

“There’s more uncertainty out there than anything else,” said LBBW’s Karl Haeling. But a rise on US bond yields — at least partially due to speculation that a return to the White House by Donald Trump would lead to tax cuts that fuel inflation — have acted as a headwind. Next week will see five of the “Magnificent Seven” tech stocks reporting earnings, including Alphabet (Google), Amazon, Apple, Meta (Facebook), and Microsoft. Key US monthly jobs numbers come out on Friday.

“This could prove a big test for the markets, while also being a driver of sentiment as we head towards year-end,” said Trade Nation analyst David Morrison. In Europe, London ended the day down 0.3 percent as investors awaited the first budget of Britain’s new Labour government on Wednesday, expected to include tax rises on businesses. Meanwhile, shares in British bank NatWest jumped nearly five percent before paring gains as investors welcomed the lender’s strong increase in profits, with income higher thanks to interest rates remaining elevated.

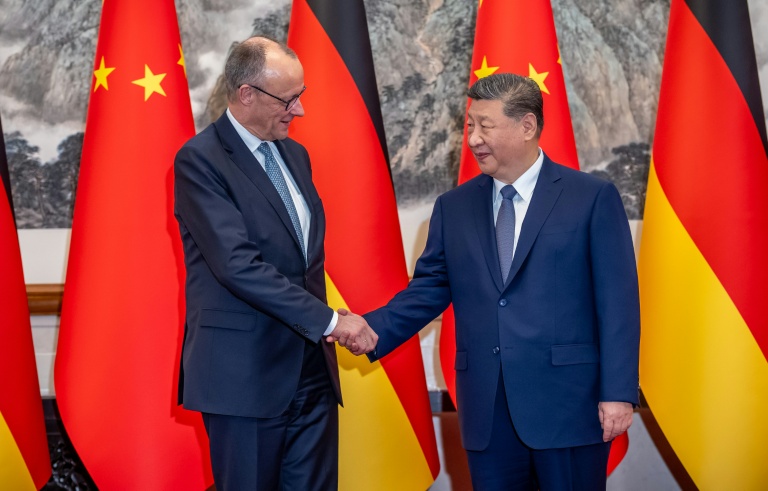

Frankfurt edged higher after data showed Germany’s business confidence rebounded in October. That ended a four-month streak of declines and offered some rare good news for Europe’s beleaguered top economy. Mercedes-Benz stock shed around 1.5 percent after the German luxury carmaker said group profits slumped more than 50 percent, hit by weakness in the key Chinese market.

In Asia, Shanghai and Hong Kong markets rose amid hopes of stronger growth in China following the country’s recent attempts to stimulate its stalling economy. Crude futures climbed, and the dollar strengthened against main rivals heading into the weekend break. Tokyo’s stock market closed down, and the yen dipped against the dollar ahead of Japan’s national elections on Sunday. Independent analyst Stephen Innes pointed to uncertainty over the vote and an upcoming Bank of Japan policy meeting as complicating the outlook for Japanese equities.

“Between election jitters and BoJ chess moves, Tokyo markets are probably in for a busy opening on Monday.”

– Key figures around 2030 GMT –

New York – Dow: DOWN 0.6 percent at 42,114.40 (close)

New York – S&P 500: DOWN less than 0.1 percent at 5,808.12 (close)

New York – Nasdaq Composite: UP 0.6 percent at 18,518.61 (close)

London – FTSE 100: DOWN 0.3 percent at 8,248.84 (close)

Paris – CAC 40: DOWN 0.8 percent at 7,497.54 (close)

Frankfurt – DAX: UP 0.1 percent at 19,463.59 (close)

Tokyo – Nikkei 225: DOWN 0.6 percent at 37,913.92 (close)

Hong Kong – Hang Seng Index: UP 0.5 percent at 20,590.15 (close)

Shanghai – Composite: UP 0.6 percent at 3,299.70 (close)

Euro/dollar: DOWN at $1.0799 from $1.0828 on Thursday

Pound/dollar: DOWN at $1.2958 from $1.2975

Dollar/yen: UP at 152.27 yen from 151.83 yen

Euro/pound: UP at 83.30 pence from 83.44 pence

Brent North Sea Crude: UP 2.3 percent at $76.05 per barrel

West Texas Intermediate: UP 2.3 percent at $71.78 per barrel

burs-jmb/bgs

© 2024 AFP