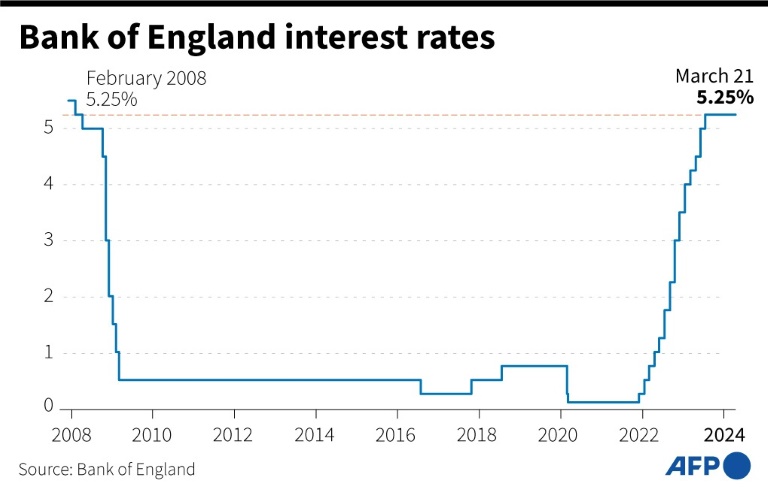

London (AFP) – European and Asian stock markets diverged Friday as traders closed out a week dominated by key central bank decisions on interest rates. London’s FTSE 100 index was up 0.7 percent nearing midday, having gained almost two percent Thursday as the Bank of England signalled it could start cutting interest rates over the UK summer.

The pound extended losses against the dollar Friday.

In the eurozone, the Paris stock market fell and Frankfurt edged up with investors having already priced in a rate cut from the European Central Bank in June.

“It’s been quite the week for news flow,” noted Russ Mould, investment director at AJ Bell. “Naturally, everything has centred around central bank interest rate decisions and while the US and UK kept their rates level, it’s all about what could happen next, and confidence is growing that we’ll see rate cuts soon.”

The Swiss National Bank on Thursday became the first major Western central bank to cut interest rates after a sustained period of hikes designed to combat soaring inflation, followed later in the day by the Bank of Mexico.

All eyes are now on when the US Federal Reserve will follow suit.

Wall Street’s three main indices posted record highs Thursday for a second straight session thanks to a tech rally as traders contemplated an end to the era of two-decade high rates in the United States.

But Asian stock markets mostly fell Friday as data pointing to a still-strong US economy raised fresh concerns about inflation and whether the Fed really would slash interest rates as much as it expected this year, analysts said.

Equities across the world had surged Thursday in response to the Fed’s closely watched dot plot projection that it would lower borrowing costs three times this year, even after figures showed prices ticking up in January and February.

In Asia on Friday, Hong Kong closed down more than two percent, with tech firms tanking after a US official said chip maker Semiconductor Manufacturing International Corp “potentially” broke US law by producing a processor for sanctioned Chinese telecom giant Huawei.

Shanghai, Sydney, Singapore, Seoul, Bangkok, Manila and Jakarta stocks were also down.

However, Tokyo, Taipei, Mumbai and Wellington rose.

The yen strengthened slightly after the release of figures showing a 2.8-percent jump in Japanese inflation, which sparked debate about whether the country’s central bank will follow up this week’s interest rate hike — the first in 17 years — with further raises, something it had appeared to rule earlier in the week.

– Key figures around 1130 GMT –

London – FTSE 100: UP 0.7 percent at 7,935.75 points

Paris – CAC 40: DOWN 0.3 percent at 8,159.76

Frankfurt – DAX: UP 0.1 percent at 18,190.56

EURO STOXX 50: DOWN 0.5 percent at 5,027.55

Tokyo – Nikkei 225: UP 0.2 percent at 40,888.43 (close)

Hong Kong – Hang Seng Index: DOWN 2.2 percent at 16,499.47 (close)

Shanghai – Composite: DOWN 1.0 percent at 3,048.03 (close)

New York – Dow: UP 0.7 percent at 39,781.37 (close)

Pound/dollar: DOWN at $1.2585 from $1.2653 on Thursday

Dollar/yen: DOWN at 151.58 yen from 151.65 yen

Euro/dollar: DOWN at $1.0823 from $1.0861

Euro/pound: UP at 86.01 pence from 85.82 pence

Brent North Sea Crude: UP 0.1 percent at $85.83 per barrel

West Texas Intermediate: UP 0.1 percent at $81.17 per barrel

© 2024 AFP