New York (AFP) – European and US stocks rebounded Wednesday from the previous day’s sharp losses, as dealers went fishing for bargains, digested lower-than-expected UK inflation and shrugged off equity losses elsewhere.

Equities on both sides of the Atlantic tumbled on Tuesday after data showed that US inflation had slowed less than expected in January. That dealt a body blow to hopes of an early Federal Reserve interest rate cut and sent Asia indices mostly lower on Wednesday.

But European indices climbed in Wednesday trading and Wall Street pushed higher, coming off losses of more than one percent.

“Dip buyers have come in following yesterday’s drop in the wake of US inflation data, mounting a holding action that is preventing any further downside for the time being,” said Chris Beauchamp, chief market analyst at online trading platform IG.

David Morrison, senior analyst at Trade Nation, said “the prevailing feeling is that yesterday’s knee-jerk reaction may be enough to reset equity markets following their near-uninterrupted bullish run since October last year.” Wall Street’s top stock indices have struck new highs in recent months on expectations that the Fed will begin cutting interest rates and on stellar earnings from tech firms.

Morrison said “bullish sentiment prevails thanks to the robustness of the US economy and the health of the employment situation across the US, UK and eurozone.”

The January consumer price index showed that US inflation is coming down, even if not as fast as markets had hoped. Morrison said that markets now expected the Fed to begin cutting rates in the middle of this year, and to make fewer reductions.

After the market closed Wednesday, a senior Fed official said the US central bank should be “careful” about the timing of interest rate cuts. The Fed’s vice chair for supervision, Michael Barr, said he was “confident” that inflation was heading back to two percent. “We need to see continued good data before we can begin the process of reducing the federal funds rate,” Barr said.

Eyes are now on US producer price data due at the end of the week.

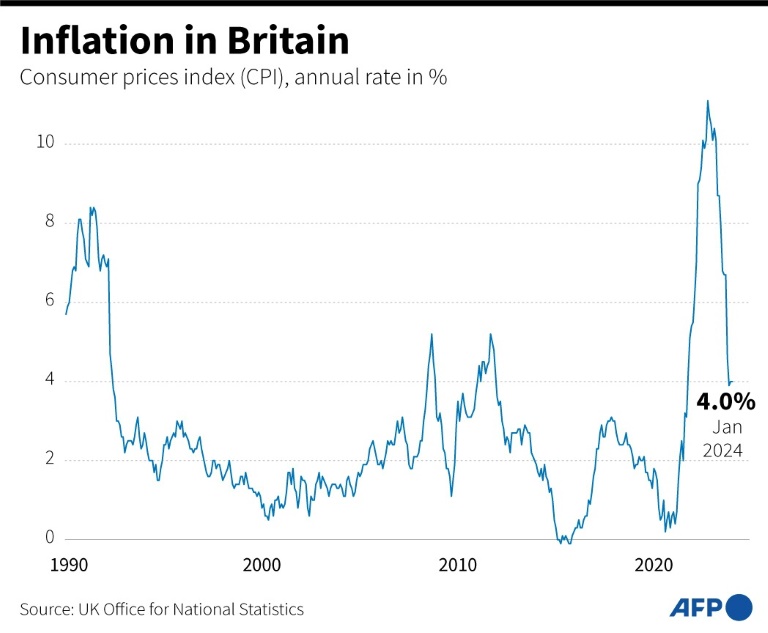

Data released Wednesday showing UK inflation held at four percent in January has helped offset some concern about the delayed cut in US interest rates, said OANDA analyst Craig Erlam. The data undershot expectations but was double the Bank of England’s target.

“It’s all about progress towards the goal of two-percent inflation and (interest) rates falling — and today is another encouraging step toward that,” Erlam told AFP.

Asian traders ran for cover following the US inflation data, with Tokyo, Sydney, Singapore, Seoul, Wellington, Mumbai and Bangkok well down on Wednesday. Hong Kong rallied, however, as it reopened after an extended break for the Lunar New Year. Tech giants led the way on hopes China’s leaders will announce further measures to support the country’s markets and stuttering economy.

– Key figures around 2130 GMT –

New York – Dow: UP 0.4 percent at 38,424.27 (close)

New York – S&P 500: UP 1.0 percent at 5,000.62 (close)

New York – Nasdaq Composite: UP 1.3 percent at 15,859.15 (close)

London – FTSE 100: UP 0.8 percent at 7,568.40 (close)

Paris – CAC 40: UP 0.7 percent at 7,677.35 (close)

Frankfurt – DAX: UP 0.4 percent at 16,945.48 (close)

EURO STOXX 50: UP 0.4 percent at 4,709.22 (close)

Tokyo – Nikkei 225: DOWN 0.7 percent at 37,703.32 (close)

Hong Kong – Hang Seng Index: UP 0.8 percent at 15,879.38 (close)

Shanghai – Composite: Closed for holiday

Euro/dollar: UP at $1.0730 from $1.0709 on Tuesday

Dollar/yen: DOWN at 150.60 yen from 150.80 yen

Pound/dollar: UP at $1.2564 from $1.2592

Euro/pound: UP at 85.37 pence from 85.04 pence

Brent North Sea Crude: DOWN 1.4 percent at $81.60 per barrel

West Texas Intermediate: DOWN 1.6 percent at $76.64 per barrel

burs-jmb/bys