London (AFP) – Stock markets retreated Wednesday after the US government imposed restrictions on exports of a key Nvidia chip to China, the latest trade war salvo between the world’s biggest economies. After a relatively peaceful couple of days on markets following tariff-related volatility last week, investors were once again on the defensive, sending safe-haven gold above $3,300 an ounce for the first time.

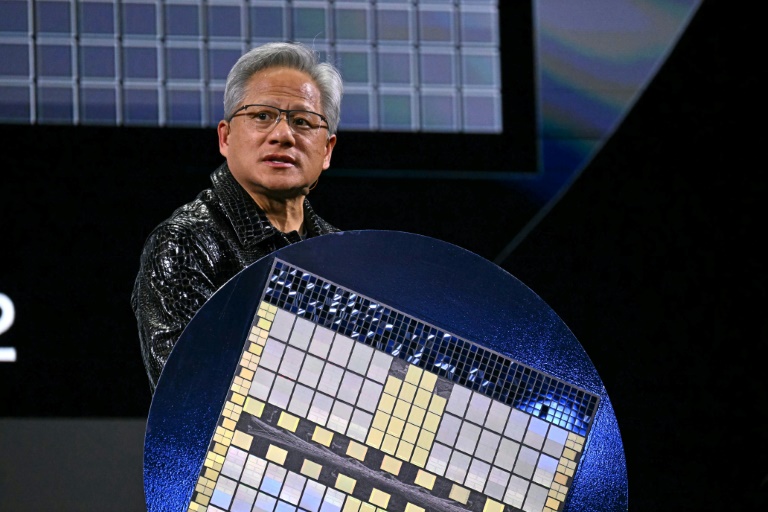

Wall Street fell in opening deals, with Nvidia shares tanking by more than six percent, and the dollar and US government bonds were under pressure again. Nvidia notified regulators late Tuesday that it expected a $5.5 billion hit this quarter owing to a new US licensing requirement on the chip it can legally sell in the Asian country. The company at the heart of helping to power artificial intelligence said it must obtain licenses to export its H20 chips to China because of concerns they would be used in supercomputers there.

“It’s another stark reminder that geopolitics and technology remain deeply entangled — and that markets will continue to dance to Washington’s tune, whether they like it or not,” said Fawad Razaqzada, market analyst at City Index and Forex.com. The United States on Monday opened the door to tariffs targeting semiconductors and chip-making equipment, with Trump saying Sunday an announcement would be made “over the next week”. Trump has also kicked off an investigation that could see tariffs imposed on critical minerals such as rare earths, which are used in a wide range of products including smartphones, wind turbines, and electric vehicle motors.

It is the latest front in Trump’s erratic trade war, which has seen the US leader impose a universal 10 percent duty, pause higher levies on some countries, and temporarily exempt some sectors from duties. “Markets continue to suffer from the White House’s tariff flip-flopping,” Razaqzada said. “The stop-start nature of US trade policy this month has made long-term positioning something of a fool’s errand, with volatility dominating the landscape.”

In Europe, London’s benchmark FTSE 100 stock index was down about 0.2 percent in afternoon deals, even as official data showed UK inflation slowed more than expected in March. Shares in Dutch tech giant ASML, which makes machines that produce semiconductors, fell six percent as its net bookings came in below expectations. ASML’s disappointing earnings report “has only added to the sector-wide tech concerns,” said David Morrison, analyst at Trade Nation.

The dollar slid once more against main rivals and yields on 10-year Treasury bills rose again, an indication of doubts about the haven status of US bonds. Gold hit a record $3,317.75 an ounce before paring back gains. Oil prices rose more than one percent after recent sharp falls on fears that the tariffs will dampen global economic growth.

Trump’s most recent moves mark the latest salvo in an increasingly nasty row that has seen Washington and Beijing hit each other with eye-watering tariffs. China did little to soothe worries Wednesday by saying US levies were putting pressure on its economy, even if official data showed it expanded more than expected in the first quarter. Beijing told Washington to “stop threatening and blackmailing” after Trump said it was up to Beijing to come to the negotiating table to discuss ending their trade war.

– Key figures around 1335 GMT –

New York – Dow: DOWN 0.3 percent at 40,248.03 points

New York – S&P 500: DOWN 0.9 percent at 5,350.74

New York – Nasdaq: DOWN 1.7 percent at 16,535.69

London – FTSE 100: DOWN 0.2 percent at 8,229.31

Paris – CAC 40: DOWN 0.5 percent at 7,298.20

Frankfurt – DAX: DOWN 0.3 percent at 21,183.34

Tokyo – Nikkei 225: DOWN 1.0 percent at 33,920.40 (close)

Hong Kong – Hang Seng Index: DOWN 1.9 percent at 21,056.98 (close)

Shanghai – Composite: UP 0.3 percent at 3,276.00 (close)

Euro/dollar: UP at $1.1363 from $1.1291 on Tuesday

Pound/dollar: UP at $1.3268 from $1.3232

Dollar/yen: DOWN at 142.60 yen from 143.18 yen

Euro/pound: UP at 85.65 pence from 85.30 pence

Brent North Sea Crude: UP 1.2 percent at $65.42 per barrel

West Texas Intermediate: UP 1.2 percent at $61.48 per barrel.

burs-bcp-lth/js

© 2024 AFP