London (AFP) – Major tech stocks bounced higher Thursday after posting heavy losses the previous day on trade fears, helping Wall Street to mostly advance.

The tech-heavy Nasdaq Composite rose 0.7 percent at the start of trading after slumping 2.8 percent the previous day. The S&P 500 added 0.3 percent while the blue-chip Dow shed 0.3 percent after having set a third consecutive record close on Wednesday.

Europe’s major stock markets also rose, London energised by the previous day’s oil price surge, while Asia stumbled after on tech sector concerns.

London’s FTSE 100 index rallied with BP and Shell shares gaining more than one percent as investors also digested steady UK unemployment data. Oil prices had vaulted two percent higher Wednesday after signs of strengthening crude demand in top consumer the United States, though the market stabilised Thursday. Energy majors tend to win a shot in the arm from rising crude futures that boost their revenues and profits.

The dollar firmed following losses caused by growing expectations the US Federal Reserve would cut interest rates at least once this year. As expected, the European Central Bank on Thursday kept its key interest rates steady as it waits for firm indications that consumer price rises are stable before reducing borrowing costs again. The bank kept the key deposit rate at 3.75 percent, after the first cut in June ended an unprecedented streak of hikes to tame runaway inflation. But ECB chief Christine Lagarde said there was no pre-determined rate path and the decision at September’s meeting was “wide open” and would depend upon the data.

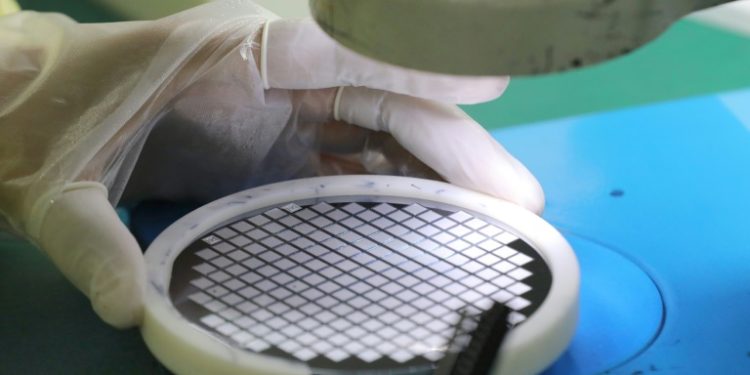

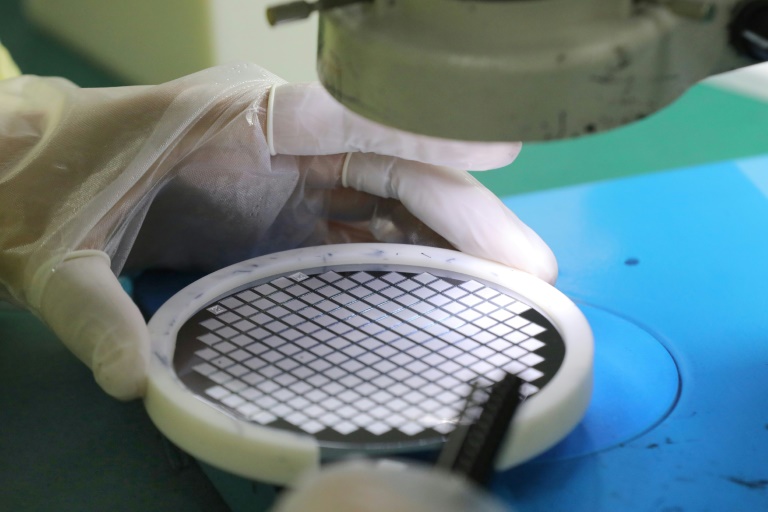

On Wednesday, tech firms took a hit after a report said US President Joe Biden would target firms supplying China with key semiconductor technology. Biden is reportedly looking at imposing strict curbs on companies including Tokyo Electron and Dutch firm ASML if they continued allowing Beijing access to their chip tech. Sentiment was also dented by Donald Trump’s comments that crucial chip supplier Taiwan — home to TSMC and other major producers — should pay the US for helping the island defend itself militarily against China. Nvidia shares, which slumped more than six percent Wednesday, bounced 3.5 percent higher at the start of trading on Thursday. Shares in ASML, rose 2.5 percent after tumbling 12.7 percent on Wednesday. Shares in Tokyo Electron dived 8.8 percent in trading in Tokyo on Thursday. “An interview with Donald Trump, for Bloomberg Businessweek, saw the former president casting doubt on US willingness to defend Taiwan, should he be (re)elected in November,” said Steve Clayton, head of equity funds at Hargreaves Lansdown. “With much of the world’s most advanced chip manufacturing capabilities located within Taiwan…that was not a message the market wanted to hear. “Nor did it want to hear the Biden administration talking about tougher trade restrictions against China,” Clayton said.

The latest data showed modest increases in first-time and continuing claims for unemployment benefits in the United States. “The key takeaway from the report is that it fits with the view that there is some softening in the labor market, which is a trend that will massage the market’s belief that the Fed is likely to cut the target range for the fed funds rate before the end of the year,” said Briefing.com analyst Patrick O’Hare.

– Key figures around 1330 GMT –

New York – Dow: DOWN 0.3 percent at 41,088.76 points

New York – S&P 500: UP 0.3 percent at 5,602.94

New York – Nasdaq Composite: UP 0.7 percent at 18,119.61

London – FTSE 100: UP 0.7 percent at 8,246.84

Paris – CAC 40: UP 1.0 percent at 7,644.53

Frankfurt – DAX: UP 0.4 percent at 18,516.70

EURO STOXX 50: UP 0.6 percent at 4,921.92

Tokyo – Nikkei 225: DOWN 2.4 percent at 40,126.35 (close)

Hong Kong – Hang Seng Index: UP 0.2 percent at 17,778.41 (close)

Shanghai – Composite: UP 0.5 percent at 2,977.13 (close)

Euro/dollar: DOWN at $1.0919 from $1.0941 on Wednesday

Pound/dollar: DOWN at $1.2980 from $1.3012

Dollar/yen: UP at 156.48 yen from 156.33 yen

Euro/pound: UP at 84.12 pence at 84.07 pence

West Texas Intermediate: UP 0.1 percent at $82.93 per barrel

Brent North Sea Crude: UNCHANGED at $85.08 per barrel

© 2024 AFP