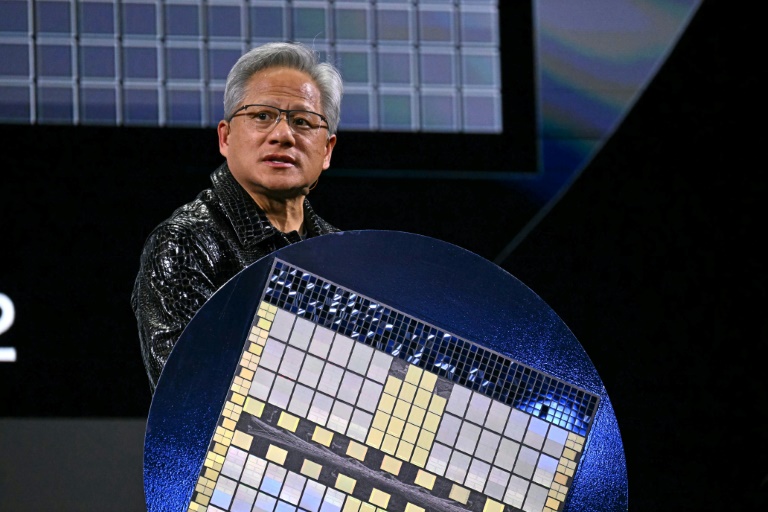

New York (AFP) – Hopes for a Santa Claus rally on Wall Street fell Friday as tech stocks slid lower, while a weaker yen lifted Japanese equities. US indices slumped to end the holiday week, with the tech-heavy Nasdaq Composite losing 1.5 percent. Shares in Tesla closed around 5.0 percent lower, while those in AI chipmaker Nvidia shed around 2.0 percent. Wall Street stocks have historically performed well around the year-end holidays in what is popularly known as a Santa Claus rally. A Christmas Eve jump in equities got the Santa rally off to a flying start, and indices barely budged in Thursday trading.

Briefing.com analyst Patrick O’Hare also pointed to an increase in 10-year US Treasury bond yields to around 4.6 percent, which he noted is a rise of nearly 0.9 percentage points since the US Federal Reserve made its first recent interest rate cut in September. “The Fed doesn’t hold sway over longer-dated maturities like it does over shorter-dated securities, so the bump in rates at the back end of the curve is being watched with an anxious eye as a possible harbinger of a pickup in inflation and/or the budget deficit,” O’Hare said. Wall Street stocks took a knock earlier this month when the Fed indicated it would likely cut interest rates less than it had previously expected to. That was in part because of uncertainty tied to President-elect Donald Trump’s vow to raise import tariffs, which could boost inflation that is already proving sticky.

In Asia, Japan’s Nikkei index closed up nearly two percent, with the yen’s recent weakness proving a boon for major exporters. The yen hit 158.08 per US dollar on Thursday evening—its lowest in almost six months—following comments made by Bank of Japan Governor Kazuo Ueda that failed to give a clear signal on a possible interest rate increase next month. Recent data has shown Japan’s inflation rose for a second month in December, while industrial production declined less than expected in November, and retail sales came in higher than estimated last month. Japan’s government also on Friday approved a record budget for the next fiscal year, ramping up spending on social welfare for its aging population and on defense to tackle regional threats.

In Seoul, the stock market closed down one percent after the won plunged to a nearly 16-year low of 1,487.03 against the dollar on Friday morning. South Korea is struggling to emerge from political turbulence in the wake of President Yoon Suk Yeol’s martial law declaration this month, which prompted his impeachment. Acting President Han Duck-soo was also impeached Friday in a vote that prompted governing party lawmakers to protest with angry chants and raised fists. South Korea’s business outlook for January fell in the Bank of Korea’s composite sentiment index, the biggest month-on-month slide since April 2020, according to data based on almost 3,300 firms released Friday.

In Europe, Frankfurt’s DAX index rose after German President Frank-Walter Steinmeier dissolved parliament on Friday and confirmed the expected date for the early general election, emphasizing the need for “political stability” in Europe’s largest economy.

– Key figures around 2115 GMT –

New York – Dow: DOWN 0.8 percent at 42,992.21 (close)

New York – S&P 500: DOWN 1.1 percent at 5,970.84 (close)

New York – Nasdaq Composite: DOWN 1.5 percent at 19,722.03 (close)

London – FTSE 100: UP 0.2 percent at 8,149.78 (close)

Paris – CAC 40: UP 1.0 percent at 7,355.37 (close)

Frankfurt – DAX: UP 0.7 percent at 19,984.32 (close)

Tokyo – Nikkei 225: UP 1.8 percent at 40,281.16 points (close)

Seoul – Kospi: DOWN 1.0 percent at 2,404.77 (close)

Hong Kong – Hang Seng Index: UP 0.1 percent at 20,116.93 (close)

Shanghai – Composite: UP 0.1 percent at 3,400.14 (close)

Euro/dollar: UP at $1.0429 from $1.0424 on Thursday

Pound/dollar: UP at $1.2579 from $1.2526

Dollar/yen: DOWN at 157.89 yen from 158.00 yen

Euro/pound: DOWN at 82.87 pence from 83.19 pence

West Texas Intermediate: UP 1.4 percent at $70.60 per barrel

Brent North Sea Crude: UP 1.2 percent at $74.17 per barrel

burs-rl/rlp/bys/sms

© 2024 AFP