Hong Kong (AFP) – Tokyo led most Asian markets higher Friday on optimism about a Japan-US trade deal as investors keep tabs on countries’ tariff talks with the White House. US President Donald Trump’s remarks that he was reluctant to further hike levies on Beijing also provided a little support amid hope for an easing of tensions between the economic titans.

Governments around the world are lining up to visit the US president’s team in an effort to pare back eye-watering levies Trump imposed for what he calls years of being “ripped off” and to reshore manufacturing. While several officials have been in touch, Japanese negotiator Ryosei Akazawa’s trip this week was seen as a canary in the mine owing to the countries’ long-running relationship. Akazawa met Trump, Trade Representative Jamieson Greer, and Treasury Secretary Scott Bessent on Wednesday without making any immediate progress, though a second round of talks is scheduled for the end of April.

On Friday, US Ambassador to Japan George Glass said he was “extremely optimistic that a deal will get done”. The day before, Trump hailed “big progress” in the negotiations. Hopes most of the measures against US trading partners can be rowed back have soothed some market anxiety after the white-knuckle ride at the start of the month, though uncertainty caused by the president’s tendency to flip-flop is keeping investors on edge.

Trump on Thursday offered a little optimism when he said he was reluctant to keep hiking rates on China as that could halt trade between the two economic superpowers, adding that Beijing had been reaching out to him. “I have a very good relationship with President Xi (Jinping), and I think it’s going to continue,” he said. “And I would say they have reached out a number of times.” His remarks came after Bloomberg reported that China could be open to dialogue but wanted to see some measures beforehand, including reining in some cabinet members’ anti-Beijing comments.

Still, Washington unveiled new port fees on Chinese built and operated ships Thursday as it looks to boost its domestic shipbuilding industry and curb China’s dominance in the sector. The move stems from a probe launched under Joe Biden’s administration but could further ratchet up tensions. After a mixed lead from Wall Street, Asia mostly rose. Tokyo led the gains even as data showed Japanese inflation accelerated last month as rice prices more than doubled. Seoul, Bangkok, and Taipei also rose, though Shanghai edged down. Hong Kong, Sydney, New York, London, Paris, Frankfurt, Singapore, Mumbai, Jakarta, Wellington, and Manila were closed for holidays.

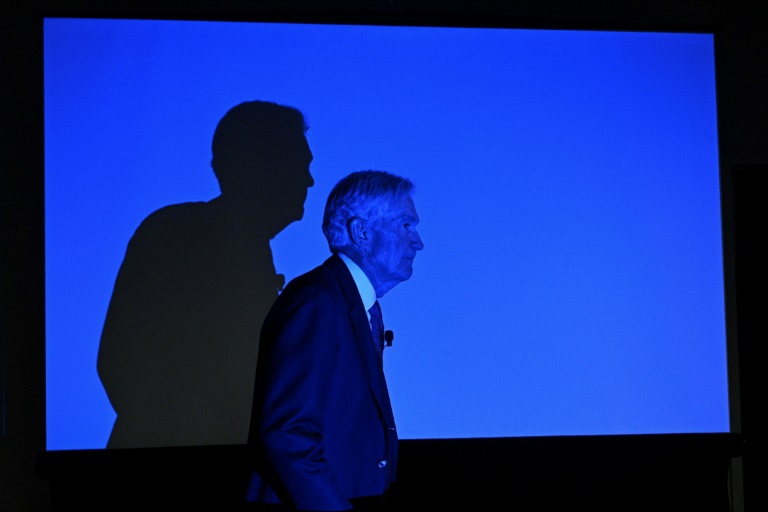

Investors are also eyeing developments at the Federal Reserve as Trump hit out at boss Jerome Powell, who warned the sweeping tariffs were “highly likely to generate at least a temporary rise in inflation”. The president slammed Powell for not lowering interest rates, as the ECB has done, and said his “termination cannot come fast enough”. Speaking to reporters at the White House, he said Powell would “leave if I ask him to”, adding “I’m not happy with him. I let him know it and if I want him out, he’ll be out of there real fast, believe me”.

Michael Hewson at MCH Market Insights pointed out that US inflation was far higher than the Fed’s two percent target and the tariff policy had created “significant ripples in the US economy, prompting a collapse in consumer confidence in the process”. “Trump is amping up the pressure on the Fed to cut rates quickly,” he wrote in a note. “Sadly, for Trump his very policies are the ones causing the Fed to pause, with Powell warning that the sheer size of the tariffs is complicating the central bank’s job.” The chaos being unleashed by the US administration is also giving business cause for concern.

In company news, Shenzhen-listed shares in Chinese battery maker CATL dropped 0.2 percent after US lawmakers asked Wall Street titans JP Morgan and Bank of America not to work on its planned initial public offering in Hong Kong. In letters to the banks’ CEOs, John Moolenaar, chair of the House Select Committee on the Chinese Communist Party, said the underwriting of the IPO exposed themselves and investors to “significant regulatory, financial and reputational risks”.

– Key figures at 0715 GMT –

Tokyo – Nikkei 225: UP 1.0 percent at 34,730.28 (close)

Shanghai – Composite: DOWN 0.1 percent at 3,276.73 (close)

Hong Kong – Hang Seng Index: Closed for a holiday

Euro/dollar: UP at $1.1371 from $1.1370 on Thursday

Pound/dollar: UP $1.3270 at $1.3268

Dollar/yen: DOWN at 142.33 yen from 142.39 yen

Euro/pound: UP at 85.68 pence from 85.67 pence

West Texas Intermediate: UP 3.5 percent at $64.68 per barrel on Thursday

Brent North Sea Crude: UP 3.2 percent at $67.96 per barrel

London – FTSE 100: Closed for a holiday

New York – Dow: Closed for a holiday

© 2024 AFP