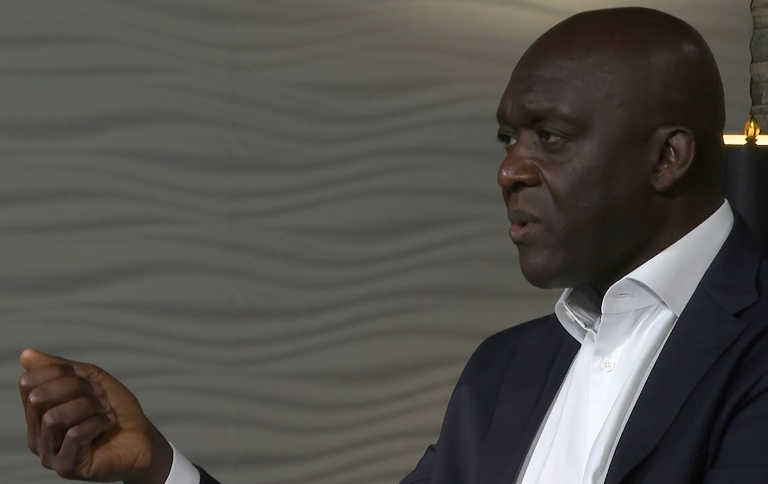

London (AFP) – British bank NatWest on Friday said net profit jumped nearly a third in 2023 on higher interest rates, adding that Paul Thwaite would become permanent chief executive following boardroom turmoil.

Profit after tax increased 32 percent to £4.4 billion ($5.5 billion), NatWest said it a statement.

Revenue climbed 12 percent to around £14.8 billion.

Thwaite takes over from Alison Rose, who resigned as CEO in July after admitting a “serious error of judgment” in speaking to a reporter about the banking affairs of arch-Brexiteer Nigel Farage.

Thwaite had filled the role on an interim basis after an internal promotion.

He said Friday that it was “an honour to lead” a bank “which plays a vital role in the lives of the 19 million customers”.

“With that, comes a great sense of responsibility to succeed for our customers, colleagues, and shareholders.”

Our customers’ needs and expectations are changing at pace, as they engage with emerging technology, adapt to new social trends, and build ever more resilience to a fast-evolving world,” the new CEO added in a statement.

An independent probe in October found that NatWest displayed “serious failings” in its treatment of the banking affairs of Farage — ex-leader of the Brexit Party and the anti-immigration party UKIP.

Farage had complained about the closure of his account with upmarket NatWest division Coutts, claiming he was removed for his political views. NatWest remains 38-percent owned by the government after a state bailout of the lender in the wake of the global financial crisis in 2008.

As the bank slowly returned to health, the government sold off chunks of its majority stake.

– Shares surge –

The bank on Friday added that operating pre-tax profit came in at £6.2 billion, the highest since 2007, or eve of the crisis.

The bank revealed also lower-than-expected impairment charges linked to defaults on mortgages as borrowers struggle with high interest rates.

Following the earnings update, NatWest’s share price soared 6.5 percent, topping London’s benchmark FTSE 100 index, which was up 1.4 percent overall.

“In all, these are a robust set of results,” noted Richard Hunter, head of markets at trading group Interactive Investor.

Despite Friday’s strong investor reaction, “the share price has tended to be dogged by the general outlook for the UK economy” in recent months, he added.

Official data Thursday showed the British economy in recession, although economists expect it to be short-lived. Figures Friday showed a sharp rebound in UK retail sales.