Washington (AFP) – US consumer inflation rose for a third straight month in December as energy prices jumped, but a widely watched measure eased slightly, raising hopes that underlying inflation may be moderating. The consumer price index (CPI) accelerated to 2.9 percent last month from a year ago, up from 2.7 percent in November, the Labor Department said in a statement on Wednesday. This was in line with the median forecast of economists surveyed by Dow Jones Newswires and The Wall Street Journal. Stocks jumped on the news, with all three major indices on Wall Street closing sharply higher.

On a monthly basis, inflation rose by 0.4 percent, slightly faster than expected. One of the biggest drivers of inflation in December was the energy index, which jumped by 2.6 percent, accounting for “over” 40 percent of the monthly increase, according to the Labor Department. In some good news for the Federal Reserve, annual inflation excluding volatile food and energy costs came in at a lower-than-expected 3.2 percent, marking a slight decline from the month earlier.

– Focus on the core –

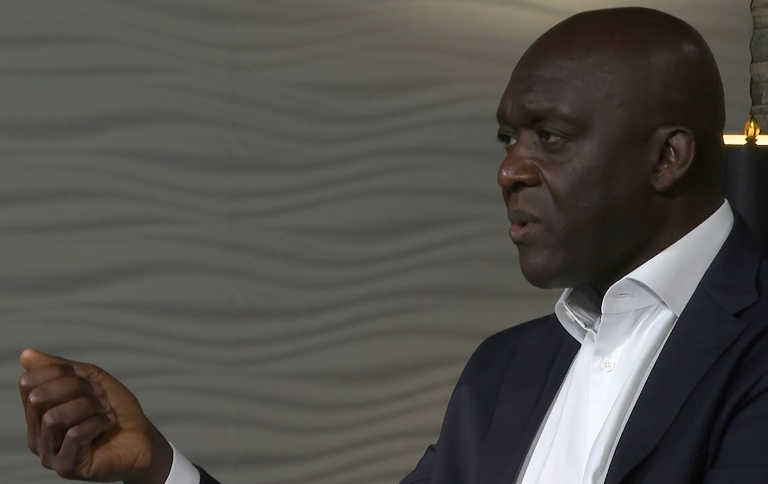

The so-called “core” measure of inflation increased by 0.2 percent, also slightly below expectations. “The focus is really on the core reading, and the core reading did come in better than the consensus expectations,” Nationwide chief economist Kathy Bostjancic told AFP. The US central bank has cut rates by a full percentage point since September as it looks to bolster the labor market. The recent uptick in inflation adds to expectations that it will remain firmly on pause at its next rate decision later this month.

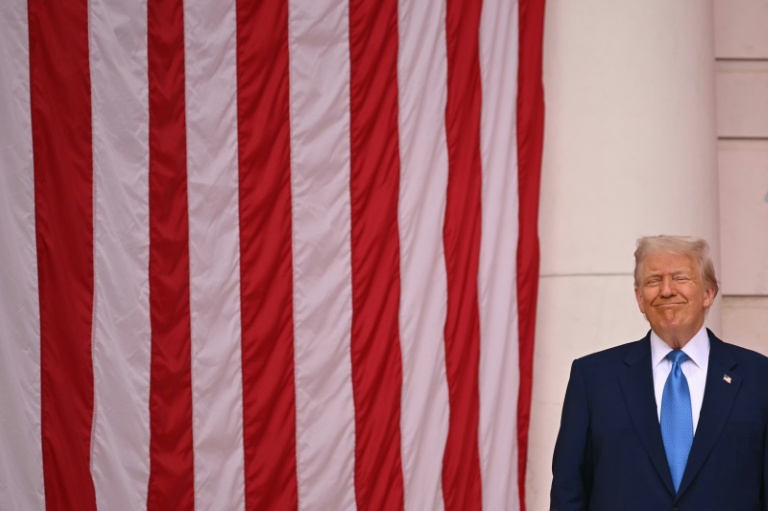

However, higher prices could complicate President-elect Donald Trump’s economic plans as he prepares to return to office on Monday. Trump has floated several policies, from tariffs to deportation, that many economists say could have an inflationary impact. The Republican and his supporters have disputed this characterization, claiming that many of his proposals aimed at deregulation and boosting energy production should help keep prices in check.

– Bond yields drop –

US bonds rallied as investors reacted to signs of slowing core inflation, pushing down yields, which move inversely to prices. “The softer core reading is really what the markets are focusing on right now, and that’s why you’re seeing a big rally in the bond market,” said Bostjancic from Nationwide. Lower yields on US Treasurys — especially the popular 10-year note — would be good news for consumers, since they are referenced by businesses when they price mortgages and car loans.

Wednesday’s data release is nevertheless expected to fuel expectations that the Fed will pause rate cuts later this month, as headline inflation appears to be moving away from its long-term goal of two percent. The Fed uses a different inflation measure to set interest rates, known as the personal consumption expenditures (PCE) price index. That index has also been rising in recent months.

Futures traders see a roughly 97 percent chance that Fed policymakers will vote to hold interest rates between 4.25 and 4.50 percent at the next rate meeting on January 28 and 29, according to data from CME Group. “The pace of inflation is still elevated,” said Bostjancic. “There’s strength in the labor market, and the prospects of changes in tariffs and immigration policies that could push inflation higher will keep the Fed cautious and patient with regard to cutting rates further,” she said.

“In that light, we see the Fed moving to the sidelines in the first half of the year to assess the evolving economic inflation and policy landscape,” she added. The financial markets see a roughly 80 percent chance that the Fed will make no more than two rate cuts this year, according to data from CME Group.

© 2024 AFP