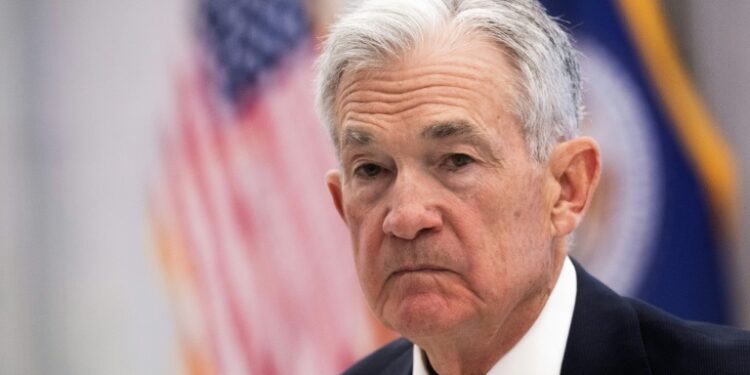

Washington (AFP) – Federal Reserve Chair Jerome Powell on Thursday warned of the possibility of “more persistent” supply shocks, as US central bankers met for talks against a backdrop of uncertainty kicked up by Donald Trump’s tariff rollout. The US president’s on-again, off-again approach to tariffs has caused a surge in volatility, with sharp movements in both US and global financial markets. Before a de-escalation this week, steep US tariffs on China and retaliatory measures by Beijing also raised fears of potentially major trade disruptions between the two countries.

“We may be entering a period of more frequent, and potentially more persistent, supply shocks — a difficult challenge for the economy and for central banks,” Powell told his colleagues in Washington. Powell’s remarks acknowledged the post-pandemic supply shock, when temporary supply chain problems caused a surge in inflation that the Fed has previously admitted it was too late to address.

In the speech, which came at the start of the Fed’s first public strategy review for five years, Powell said the economic landscape had changed since the last meeting, when interest rates were far lower than they are today. The Fed’s key lending rate currently sits at between 4.25 percent and 4.50 percent as the policymakers look to cool inflation without pushing up unemployment.

“Longer-term interest rates are a good deal higher now, driven largely by real rates given the stability of longer-term inflation expectations,” he said, referring to “real,” inflation-adjusted interest rates. The higher rates could also reflect fears of higher volatility going forward, he added.

Powell also said the Fed may reconsider its focus on targeting average inflation over time — an approach which gives policymakers the leeway to take a longer-term view if inflation deviations from its long-run two percent target for short periods. But while the Fed could tweak its approach to monetary policy, its key long-term inflation target will remain unchanged, Powell told his colleagues.

“Anchored expectations are critical to everything we do, and we remain fully committed to the two percent target today,” he said.

© 2024 AFP