Washington (AFP) – A senior Federal Reserve official said Thursday that the US central bank will likely start cutting interest rates “at some point this year,” but warned against the potentially inflationary effect of over-consumption.

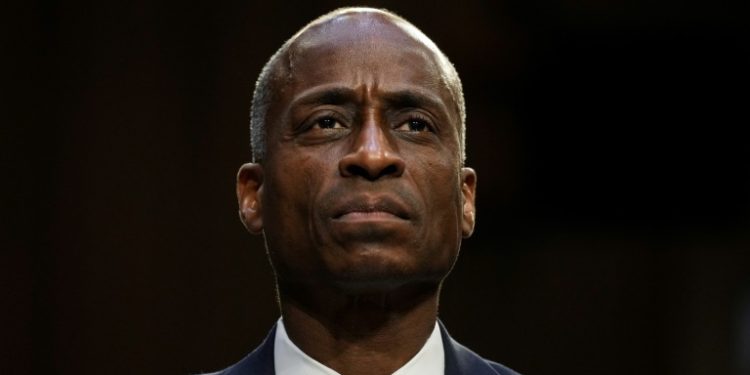

“If the economy evolves broadly as expected, it will likely be appropriate to begin dialing back our policy restraint later this year,” Fed vice chair Philip Jefferson told an event at the Peterson Institute of International Economics (PIIE) in Washington.

The number two man at the US central bank said he still expects growth in spending and production in the US to slow in 2024.

“Even so, without a clear understanding of why consumer spending has been so resilient, I see continuing strength in spending as an important upside risk to my forecast,” he said.

US households continued to spend in 2023, despite their reduced purchasing power due to inflation on the one hand, and increased interest rates on the other.

Jefferson warned about the impact of “socially motivated consumption — or ‘keeping up with the Joneses,'” which he said “could cause individuals to consume more than what is predicted by models that only consider household wealth and income.”

Excessive consumption could slow the significant progress the Fed made on inflation, despite a recent uptick.

One measure of price inflation known as the consumer price index (CPI), on which pensions are indexed, came in higher than expected in January, hitting an annual rate of 3.1 percent.

“That disappointing CPI reading highlights that the disinflation process is likely to be bumpy,” Jefferson said Thursday.

He also mentioned two other risks: a weakening labour market and the prospect of “elevated” geopolitical risks.

“A widening of the conflict in the Middle East could have greater effects on commodity prices, such as oil, and on global financial markets,” he said.

Having raised its key lending rate to between 5.25 and 5.50 percent, the Fed is now considering cutting rates.

But Fed officials are adopting a cautious approach and consider it unlikely that they will start at the next meeting in March.

Speaking later Thursday, Jefferson’s colleague on the Fed board, Governor Lisa Cook, also weighed in on when the Fed could begin cutting rates.

“When considering appropriate monetary policy, I now see two-sided risks,” she told a conference in Princeton, New Jersey in prepared remarks.

“I am now weighing the possibility of easing policy too soon and letting inflation stay persistently high versus easing policy too late and causing unnecessary harm to the economy,” she said.

Cook said she would like to have “greater confidence” that inflation was closing in on the Fed’s long-run target of two percent before “beginning to cut the policy rate.”

“I would see an eventual rate cut as adjusting policy to reflect a shifting balance of risks,” she added.