Washington (AFP) – The US Federal Reserve should proceed cautiously before supporting any future rate cuts, a senior bank official said Thursday, adding that she saw December’s rate cut as a final step for now. The US central bank voted 11-to-1 in favor of cutting rates by a quarter of a percentage point at the meeting on December 17 and 18, reducing the bank’s key lending rate to between 4.25 and 4.50 percent despite an uptick in inflation.

Speaking in California on Thursday, Fed governor Michelle Bowman said she had backed another rate cut but could have been persuaded against it. “I supported the December policy action because, in my view, it represented the Committee’s final step in the policy recalibration phase,” she said. “But given the lack of continued progress on lowering inflation and the ongoing strength in economic activity and in the labor market, I could have supported taking no action at the December meeting,” added Bowman, who is a permanent voting member of the bank’s rate-setting committee.

“We should be cautious in considering changes to the policy rate as we move toward a more neutral setting,” she said. The Fed has a dual mandate from Congress to maintain stable prices and maximum sustainable employment, and had been paring interest rates back from a two-decade high in order to better support the labor market. Lower Fed interest rates typically translate into lower borrowing costs for consumers and businesses, indirectly affecting the price of everything from mortgages to car loans.

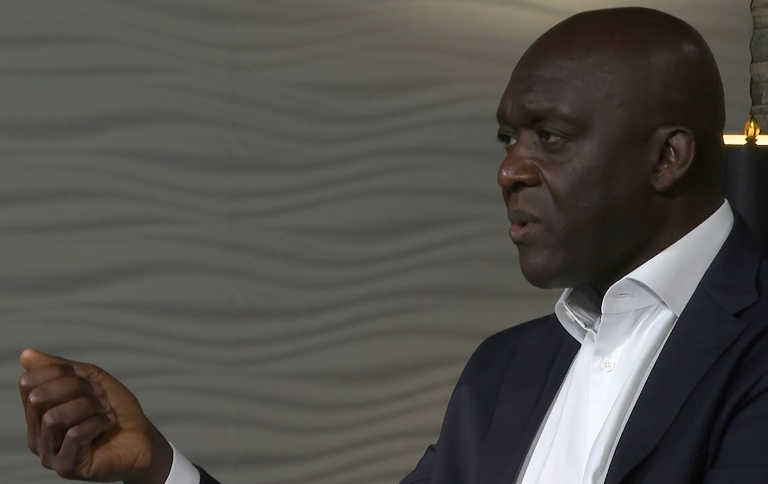

Speaking in Missouri at around the same time as Bowman, Kansas City Fed President Jeff Schmid sounded a similar note of caution about future rate cuts. “My read is that interest rates might be very close to their longer-run level now,” he said. “Regardless, I am in favor of adjusting policy gradually going forward and only in response to a sustained change in the tone of the data.” The strength of the economy allows us to be patient,” added Schmid, who has a vote on the Fed’s rate-setting committee this year.

Futures traders currently assign a probability of just under 80 percent that the Fed will make no more than two quarter-point cuts this year, according to data from CME Group.

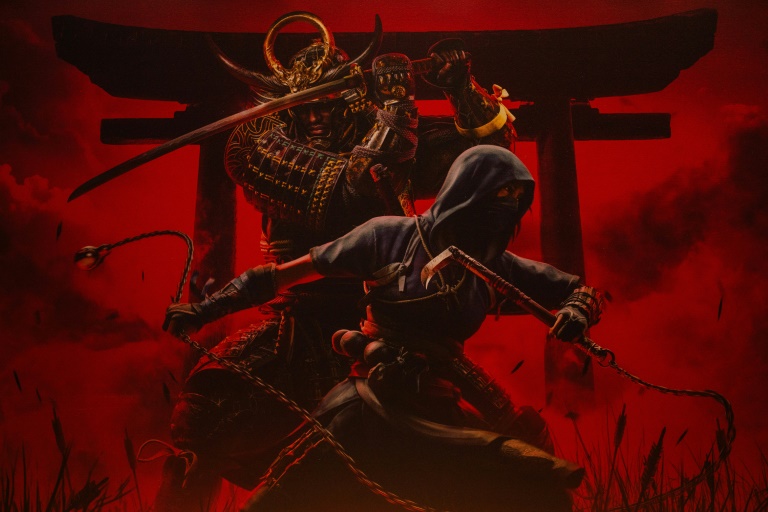

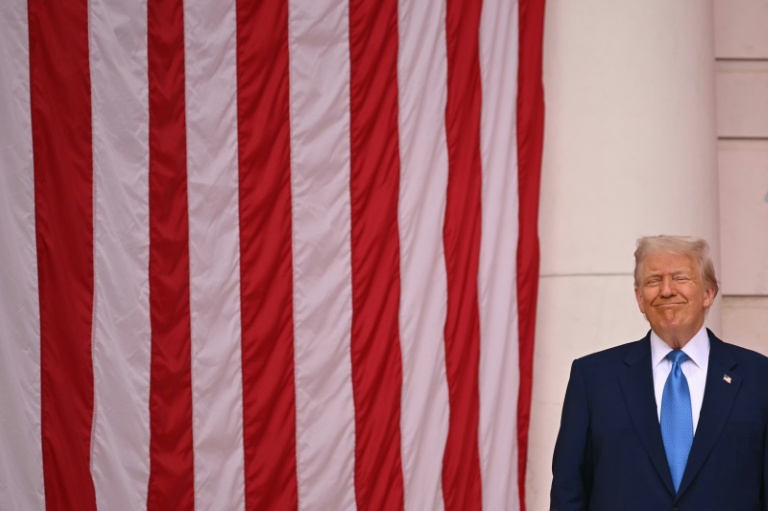

At its December meeting, Fed officials also signaled they expect fewer rate cuts going forward, sending stocks tumbling on fears that rates would have to stay higher for longer to definitively return inflation to the bank’s long-term target of two percent. Traders, analysts, and policymakers have also been weighing up the possible impact of President-elect Donald Trump’s economic proposals, which include tariffs on goods entering the United States, mass deportation, and the extension of existing tax cuts.

In minutes of the Fed’s December rate cut decision published earlier this week, the bank indicated that some policymakers had begun the process of including assumptions about Trump’s policies into their economic models. Speaking Thursday, Bowman said policymakers should “refrain from prejudging the incoming administration’s future policies.” “Instead, we should wait for more clarity and then seek to understand the effects on economic activity, the labor market, and inflation,” she added.

© 2024 AFP