Washington (AFP) – Existing home sales in the United States crept up in January, according to industry data released Thursday, on slightly higher listings and demand as buyers made the most of cooler mortgage rates.

Sales of previously owned homes rose 3.1 percent from December to January, to a seasonally adjusted annual rate of 4.0 million, said the National Association of Realtors (NAR).

This was the strongest since August 2023, as mortgage rates edged down slightly in the month.

Levels soared in recent years as the Federal Reserve rapidly lifted the benchmark lending rate to fight inflation.

With higher mortgage rates, homeowners have been reluctant to sell as they previously locked in lower levels — fueling a lack of inventory in the property market.

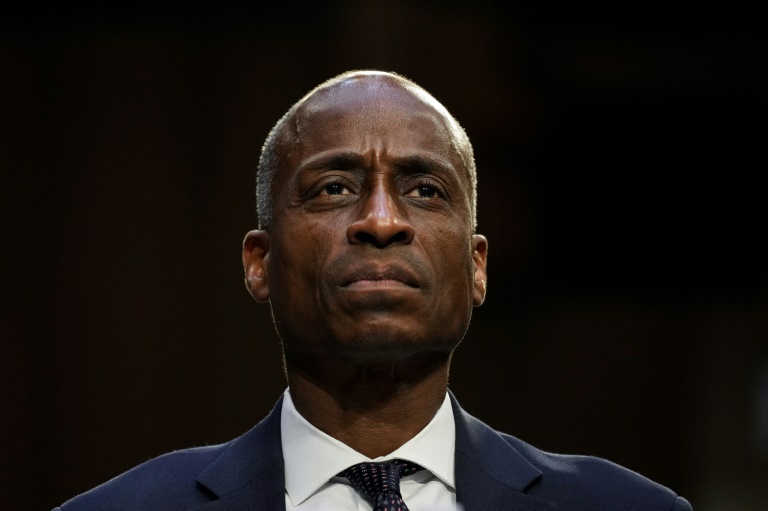

“While home sales remain sizably lower than a couple of years ago, January’s monthly gain is the start of more supply and demand,” said NAR chief economist Lawrence Yun.

Compared with January 2023, home sales were still 1.7 percent down last month.

The median price of existing homes jumped 5.1 percent from a year ago, reaching an all-time high for the month of January at $379,100.

– ‘Housing shortage’ –

In a press briefing, Yun said “home prices are again outpacing wages” for the first time in more than a year, calling this “unhealthy.”

“It is a testament to the housing shortage that we are facing in America,” he said.

Yun also noted that multiple offers for mid-priced homes are common, with many homes being sold within a month.

“The elevated share of cash deals –- 32 percent — indicated a market full of multiple offers and propelled by record-high housing wealth,” he added.

This proportion was 29 percent a year ago.

While January saw an improvement in sales, Yun said “we are not yet out of the woods.”

Averages for the popular 30-year fixed-rate mortgage hovered between 6.6 percent and 6.7 percent in January, according to home loan finance company Freddie Mac.

But as of February 15, this increased to around 6.8 percent.

“A pick-up in building activity and a decline in borrowing costs as the Fed pivots to rate cuts this year could provide support to home sales over time,” said economist Rubeela Farooqi of High Frequency Economics.

But Pantheon Macroeconomics warned: “A full recovery from the plunge in sales in 2022 and 2023, triggered by the massive increase in mortgage rates, likely will take most of the next two years.”

Existing home sales make up the vast majority of such transactions in the country.