New York (AFP) – Wall Street stocks bounced higher on Friday, but European stock markets retreated as traders booked profits from a positive start to 2025. Asia’s main equity indices closed mostly higher, with Seoul jumping nearly two percent despite deepening political uncertainty in Asia’s fourth-largest economy. There were also gains for Hong Kong, Sydney, and Taipei, although Shanghai slumped for a second session running.

Wall Street ended lower Thursday on the first US trading day of 2025, but bounced back to close the week. “People who wanted to take profits last year decided to wait until January to take profits so that they delay paying taxes on it by one year,” LBBW’s Karl Haeling told AFP. “The big question now is: is there too much bullishness in the market?” he added, referring to optimism that President-elect Donald Trump’s election victory would be good for the stock markets given his promises of tax cuts and deregulation. “Investors are anticipating a business-friendly administration from Trump and his staff,” said Jack Ablin of Cresset Capital.

Instead of enjoying a so-called Santa Claus rally of rising prices during the year-end holiday period, Wall Street limped into 2025 as investors banked their healthy 2024 gains and worried about the future. Departing President Joe Biden blocked early Friday the proposed $14.9 billion purchase of US Steel by Japan’s Nippon Steel, saying it would “create risk for our national security and our critical supply chains.” The companies disputed that the deal presented national security risks and called Biden’s rejection a political decision that failed to properly review the transaction. Nippon Steel has previously described the transaction as a lifeline to Pennsylvania’s much-diminished steel industry. US Steel’s shares slumped 6.5 percent. Nippon Steel shares had closed higher in Asian trading ahead of Biden’s announcement.

The dollar dipped Friday against the euro, pound, and yen. The US currency had Thursday reached multi-year highs against some of its main rivals, reflecting expectations that the world’s biggest economy would outpace others in 2025. The yuan on Friday hit the lowest dollar level since late 2023. “The very negative performance of China equities provides a better indication of the weakening sentiment around China assets at the start of 2025, and ahead of Trump’s return to the White House,” said Alvin Tan, head of Asia FX strategy at RBC Capital Markets.

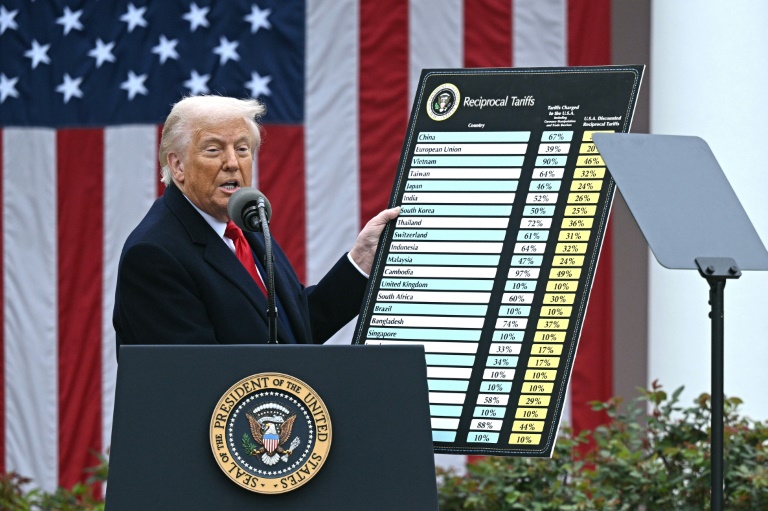

Investors are gearing up for Trump’s inauguration on January 20, set to be followed by the formal announcement of deep tariffs, especially on Chinese goods, that could rattle international trade. A monthslong US manufacturing slump lessened last month, according to better-than-expected survey data published Friday, as demand showed signs of improving. The Institute for Supply Management’s (ISM) manufacturing index was 49.3 percent last month, up 0.9 percentage points from November, it said in a statement. US jobless claims released Thursday fell more than expected, highlighting a robust labor market and leaving the Federal Reserve with less reason to support fresh rate cuts.

Other significant economic releases ahead include data on inflation and retail sales during the holiday shopping season.

– Key figures around 2125 GMT –

New York – Dow: UP 0.8 percent at 42,732.13 points (close)

New York – S&P 500: UP 1.3 percent at 5,942.47 (close)

New York – Nasdaq Composite: UP 1.8 percent at 19,621.68 (close)

London – FTSE 100: DOWN 0.4 percent at 8,223.98 (close)

Paris – CAC 40: DOWN 1.5 percent at 7,282.22 (close)

Frankfurt – DAX: DOWN 0.6 percent at 19,906.08 (close)

Tokyo – Nikkei 225: closed

Hong Kong – Hang Seng Index: UP 0.7 percent at 19,760.27 (close)

Shanghai – Composite: DOWN 1.6 percent at 3,211.43 (close)

Euro/dollar: UP at $1.0307 from $1.0269 on Thursday

Pound/dollar: UP at $1.2425 from $1.2382

Dollar/yen: DOWN at 157.33 yen from 157.52 yen

Euro/pound: UP at 82.95 pence from 82.92 pence

West Texas Intermediate: UP 1.1 percent at $73.96 per barrel

Brent North Sea Crude: UP 0.8 percent at $76.51 per barrel

© 2024 AFP