New York (AFP) – The emergence of AI bots like OpenAI’s ChatGPT and Google’s Bard has fueled a massive rise in share prices of chip-making juggernaut Nvidia, with its skyrocketing stock now making it the world’s fourth biggest company by market capitalization.

And for Wall Street, it’s no bubble.

Between the launch of ChatGPT on November 30, 2022, for example, and the market close on February 23, Nvidia’s share price increased fivefold, lifted to investor heaven by an insatiable hunger for so-called generative artificial intelligence.

That day Nvidia also crossed the symbolic valuation of $2 trillion, a threshold only reached by Microsoft, Apple and oil giant Saudi Aramco.

The journey has been nothing but mind boggling for a company that doesn’t even rank among the world’s top 150 firms in terms of sales, and barely in the top 1,000 in terms of employees.

On paper, this hot streak is reminiscent of the dot-com bubble, which saw the share price of fiber networking giant Cisco rise eightfold in 18 months, to the point of becoming, for a few minutes, the world’s most valuable company in terms of market capitalization in March 2000, before the tech bubble burst.

“In AI, there might be some names out there that might be getting a bit ahead of their skis from a valuation perspective, and those stories are going to work themselves out over time,” CFRA analyst Angelo Zino told AFP.

“But on the Nvidia side of things, it’s more fundamentally driven,” he said, without the “type of hype you had previously.”

Unlike the frothy days before the bubble popped in 2000, Nvidia’s actual annual net income (up an eye-popping 581 percent year-on-year) is on par with the stock price, said Larry Tentarelli of Blue Chip Daily Trend Report, a research firm.

For analysts at Wedbush Securities, the relevant parallel is not with 2000 and the end of the dot-com bubble, but rather with 1995, when the dot-com boom began.

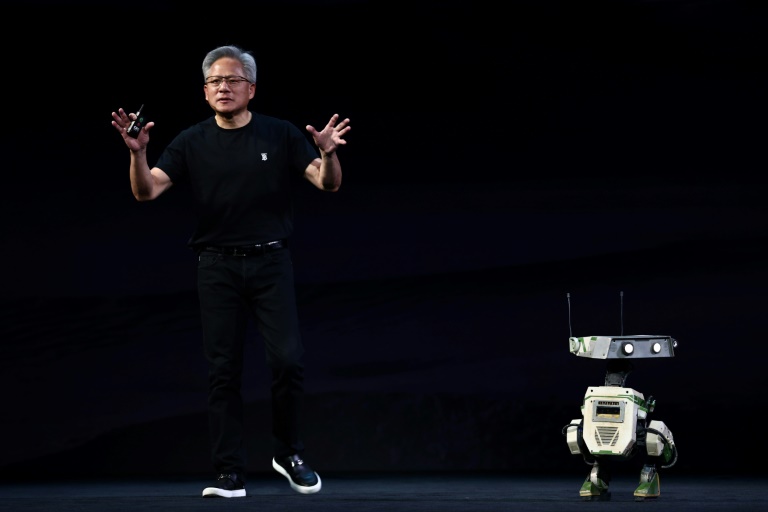

Despite appearances, Nvidia’s success is not out of the blue, but rather years in the making.

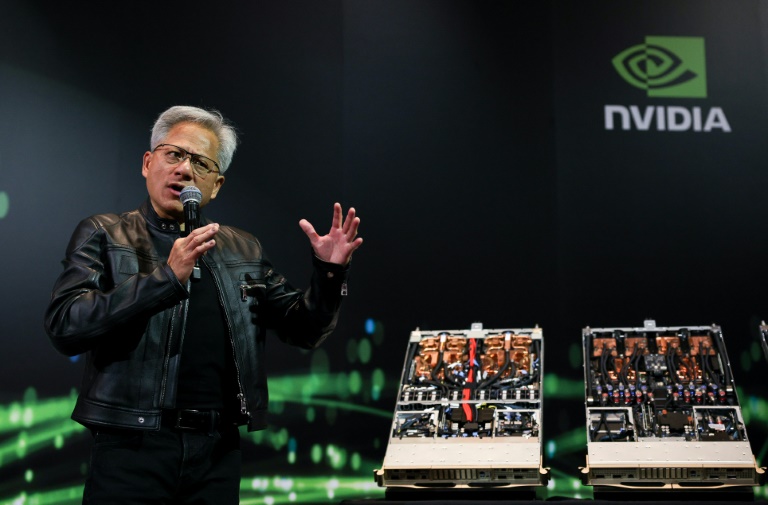

At the root of this 30-year-old company’s success are graphics processors or graphics cards, known as GPUs (graphics processing units) — chips with far greater computing capacity than conventional microprocessors (CPUs).

Initially developed to improve the graphics quality of video games, the company run by Jensen Huang figured out the technology was perfectly suited for developing the large language models (LLMs) that underpin generative AI interfaces such as ChatGPT.

Despite initial skepticism from Wall Street, Nvidia went down that road, years before programs like ChatGPT exploded onto the scene.

Now Nvidia’s rivals have set off in pursuit, and several of them, notably AMD and Intel, are already marketing their own AI-oriented GPUs, while Apple, Microsoft and Amazon have also developed chips with AI in mind.

But Nvidia “is years ahead” of its competitors, explained Tentarelli.

“The only real risk for Nvidia is if for some reason they run into some unexpected delay…if they can’t produce enough of these GPUs,” he said.

Unlike its rivals Intel, Micron and Texas Instruments, Nvidia, like AMD, does not manufacture its own semiconductors, but uses subcontractors, mainly the Taiwan Semiconductor Manufacturing Co.

Given the geopolitical concerns with Taiwan and China, this could be a potential weak spot, but Tentarelli attributes only a very low probability to a crisis.

For the time being, Zino argues, Nvidia’s business model, with no production site, is more of a strength than a weakness, as it enables it to generate higher margins and adjust its volumes more easily to demand.

When they scan the horizon, investors see no sign of a slowdown in demand for AI equipment.

For Wedbush securities, “the AI Revolution starts with Nvidia and in our view the AI party…is just getting started.”

Analysts are expecting, on average, earnings to almost double again this year compared with 2023.

“Nvidia could definitely pass Apple in 20 or 24 months and maybe sooner if it stays at the growth rate that the industry is expecting,” Tantarelli said.

As for Microsoft, the other member of the $2 trillion market cap club?

That’s a taller order, as Microsoft “is also doing a very good job” in AI, Tantarelli said.

© 2024 AFP