New York (AFP) – Gold prices hit a fresh record on Monday while the dollar tumbled further along with Wall Street equities as President Donald Trump again slammed Federal Reserve Chair Jerome Powell. US equities had opened the session lower, but stumbled further shortly after the opening bell when Trump called Powell a “major loser” for not cutting interest rates in a social media post, underscoring questions about whether Trump will attempt to fire Powell after threatening the action last week.

Worries about such a move gyrated through US markets on a day when many global markets were still closed for the Easter holiday. All three major equity indices finished down by around 2.5 percent while the US dollar retreated and Treasury bond yields moved higher. Gold prices soared to a fresh record above $3,400. There is a “narrative of weakening demand for US assets,” said Briefing.com analyst Patrick O’Hare.

Trump’s continued banter about removing or replacing Powell throws into question the independence of the US central bank, which is free from political interference as it sets monetary policy based on the imperatives of ensuring stable prices and achieving maximum employment. Investors view this tradition as foundational to American markets. Jack Ablin, chief investment officer of Cresset Capital Management, said a move to replace Powell with an appointee who would follow Trump’s demands would bring a “crisis of confidence.”

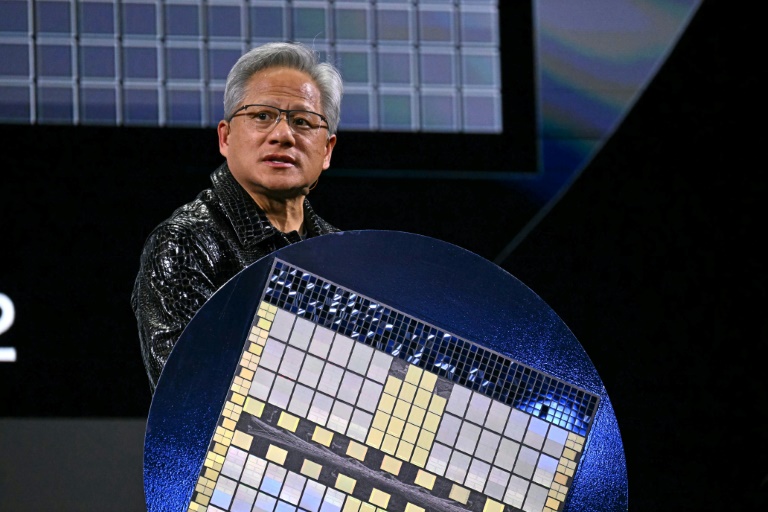

Analysts also pointed to weakness in influential technology names such as Nvidia, Google parent Alphabet, and Apple as another factor in the selling, along with trade tensions. Several nations have moved to cut a deal with Washington to stem the worst of the White House’s levies, with Japan being the highest-profile economy, while US Vice President JD Vance arrived in India on Monday for talks. However, China warned governments on Monday not to seek an agreement that compromised Beijing’s interests. While the rest of the world has been slapped with a blanket 10 percent tariff, China faces levies of up to 145 percent on many products. Beijing has responded with duties of 125 percent on US goods.

Stocks had a mixed start to the week, with Tokyo weighed down by the stronger yen while Taipei, Jakarta, and Bangkok were also in negative territory. Shanghai, Seoul, Singapore, Mumbai, and Manila saw gains. Oil prices dropped on demand fears as worries about the global economy swirl. Traders are keeping tabs on the release of key April manufacturing data around the world this week, hoping for an idea about the early impact of Trump’s tariffs.

“One thing that’s absolutely clear — and no longer debatable — is that the reputational hit to the US brand is real, and it’s not fading quietly into the next news cycle,” said Stephen Innes at SPI Asset Management. “It’s sticking. Investors, allies, and even central banks are starting to bake in the idea that American policymaking, both fiscal and monetary, is now a geopolitical variable — not a given,” he added.

– Key figures at 2045 GMT –

New York – Dow: DOWN 2.5 percent at 38,170.41 (close)

New York – S&P 500: DOWN 2.4 percent at 5,158.20 (close)

New York – Nasdaq: DOWN 2.6 percent at 15,870.91 (close)

Tokyo – Nikkei 225: DOWN 1.3 percent at 34,279.92 (close)

Shanghai – Composite: UP 0.5 percent at 3,291.43 (close)

Hong Kong – Hang Seng Index: Closed for a holiday

Euro/dollar: UP at $1.1510 from $1.1393 on Thursday

Pound/dollar: UP $1.3377 at $1.3296

Dollar/yen: DOWN at 140.89 yen from 142.18 yen

Euro/pound: UP at 86.03 pence from 85.70 pence

West Texas Intermediate: DOWN 2.5 percent at $63.08 per barrel

Brent North Sea Crude: DOWN 2.5 percent at $66.16 per barrel

London – FTSE 100: Closed for a holiday

New York – Dow: Closed for a holiday

© 2024 AFP