London (AFP) – The dollar tumbled, gold hit a fresh record high, and stock markets seesawed Friday as China again retaliated against US tariffs, deepening a trade war between the world’s two biggest economies. Wall Street opened in the red but quickly rose to cap a highly volatile week as investors grapple with President Donald Trump’s unpredictable tariffs policy. European markets wobbled as China said it would raise its tariffs on US goods to 125 percent but suggested it would not retaliate against any further US increases. Frankfurt fell and Paris was flat in afternoon deals, while London rose as data showed the UK economy grew far more than expected in February.

“The main driver of the renewed market pressure was an increased focus on the US-China escalation,” said Jim Reid, managing director at Deutsche Bank. “Neither the US nor China are showing signs of backing down, with President Trump expressing confidence in his tariff plans,” Reid added. The dollar pared back some losses against major currencies after plunging to the lowest level against the euro in more than three years as investors fled what is typically considered a key safe-haven currency.

US bonds were also under pressure amid speculation that China was offloading some of its vast holdings in retaliation for Trump’s measures. With treasuries being sold off, sending their yields higher and making US debt more expensive, there is a fear of a bigger exodus from American assets down the line. The weaker dollar and the rush for safety sent gold to a fresh record high above $3,220 an ounce. Oil prices rose slightly after huge falls on Thursday.

“There remains considerable uncertainty around the impact of tariffs on economies and company earnings, and that could keep markets volatile for some time,” noted Russ Mould, investment director at AJ Bell. Investors were also turning to more routine economic and business data, with the release of inflation data and corporate earnings. Official figures showed US producer inflation fell sharply last month before the tariffs took effect.

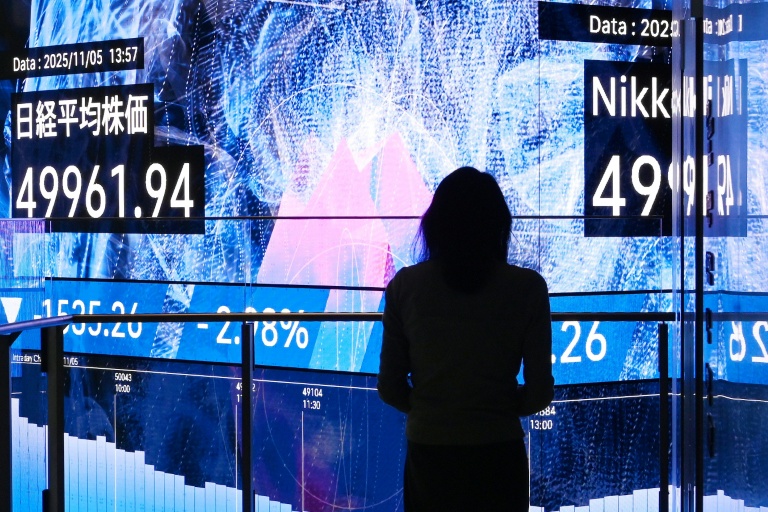

US banking giant JPMorgan Chase reported first-quarter profits of $14.6 billion, up nine percent from the same period last year. But CEO Jamie Dimon warned of “considerable turbulence” for the economy, due to tariffs, sticky inflation, fiscal deficits, and volatility. In Asia, the Tokyo stock market shed three percent — a day after surging more than nine percent — while Sydney, Seoul, Singapore, Wellington, and Bangkok were also in the red. However, Hong Kong and Shanghai rose as traders focused on possible Chinese stimulus measures. There were gains in Taipei and Ho Chi Minh City stocks as the leaders of Taiwan and Vietnam said they would hold talks with Trump.

**Key figures around 1355 GMT**

New York – Dow: UP 0.4 percent at 39,735.69 points

New York – S&P 500: UP 0.5 percent at 5,296.55

New York – Nasdaq: UP 0.8 percent at 16,525.28

London – FTSE 100: UP 0.8 percent at 7,976.03

Paris – CAC 40: FLAT at 7,125.73

Frankfurt – DAX: DOWN 0.7 percent at 20,411.34

Tokyo – Nikkei 225: DOWN 3.0 percent at 33,585.58 (close)

Hong Kong – Hang Seng Index: UP 1.1 percent at 20,914.69 (close)

Shanghai – Composite: UP 0.5 percent at 3,238.23 (close)

Euro/dollar: UP at $1.1342 from $1.1183 on Thursday

Pound/dollar: UP at $1.3071 from $1.2954

Dollar/yen: DOWN at 143.26 yen from 144.79 yen

Euro/pound: UP at 86.73 pence from 86.33 pence

Brent North Sea Crude: UP 0.5 percent at $63.62 per barrel

West Texas Intermediate: UP 0.5 percent at $60.36 per barrel

© 2024 AFP