New York (AFP) – Wall Street stocks mostly rose Tuesday while oil prices advanced, extending a rally as the improved state of US-China trade boosted the economic outlook. Both the S&P 500 and Nasdaq finished solidly higher following benign US inflation data, while the Dow retreated after weakness in UnitedHealth Group shares. Markets continued to cheer the US-China announcement on Monday of a de-escalation of trade tensions. The two countries agreed to significantly lower levies for 90 days while they work to hash out an agreement. The tech-rich Nasdaq led major US indices, winning 1.6 percent. Oil prices also climbed more than two percent as traders pencil in more oil demand.

“It seems as if the euphoria that was ignited yesterday or over the weekend has continued into today at least for the S&P 500 and the Nasdaq,” said Sam Stovall of CFRA Research. The consumer price index eased to 2.3 percent in April from a year ago, a tick below the 2.4 percent figure recorded in March. Some analysts cautioned that it was still too early to see the implications of US President Donald Trump’s tariff policies, some of which have been rolled back or suspended. But the weaker inflation data put pressure on the dollar, with more traders betting the Federal Reserve will soon cut interest rates.

In Europe, London closed barely changed, while Paris and Frankfurt both ticked up 0.3 percent. Asian equities had finished with strong gains, in their catch-up session digesting Wall Street’s jump on Monday, although Hong Kong dropped nearly two percent on profit-taking. On the corporate front, the big focus was on the auto sector after major news out of Japan.

Nissan posted an annual net loss of $4.5 billion, confirmed plans to slash 15 percent of its global workforce, and warned about the possible impact of US tariffs. The carmaker, whose mooted merger with Honda collapsed this year, is heavily indebted and engaged in an expensive business restructuring plan. For its part, Honda on Tuesday forecast a 70-percent drop in net profit for the 2025-26 financial year.

“The impact of tariff policies in various countries on our business has been very significant, and frequent revisions are being made, making it difficult to formulate an outlook,” said Honda chief executive Toshihiro Mibe.

– Key figures at around 2050 GMT –

New York – Dow: DOWN 0.6 percent at 42,140.43 (close)

New York – S&P 500: UP 0.7 percent at 5,886.55 (close)

New York – Nasdaq Composite: UP 1.6 percent at 19,010.08 (close)

London – FTSE 100: FLAT at 8,602.92 (close)

Paris – CAC 40: UP 0.3 percent at 7,873.83 (close)

Frankfurt – DAX: UP 0.3 percent at 23,638.56 (close)

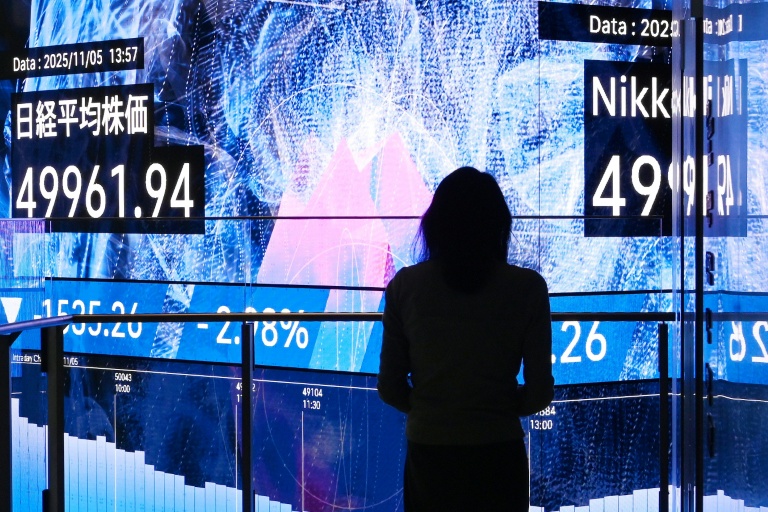

Tokyo – Nikkei 225: UP 1.4 percent at 38,183.26 (close)

Hong Kong – Hang Seng Index: DOWN 1.9 percent at 23,108.27 (close)

Shanghai – Composite: UP 0.2 percent at 3,374.87 (close)

Euro/dollar: UP at $1.1189 from $1.1087 on Monday

Pound/dollar: UP at $1.3304 from $1.3176

Dollar/yen: DOWN at 147.47 yen from 148.46 yen

Euro/pound: DOWN at 84.07 pence from 84.14 pence

Brent North Sea Crude: UP 2.6 percent at $66.63 per barrel

West Texas Intermediate: UP 2.8 percent at $63.67 per barrel

burs-jmb/jgc

© 2024 AFP